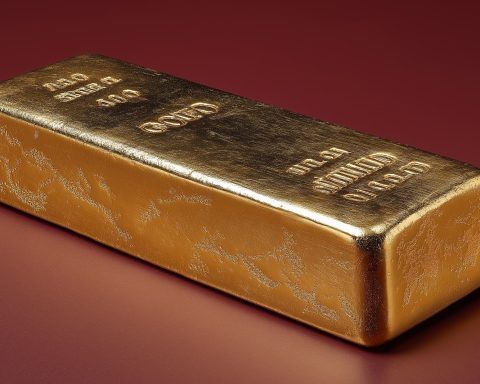

Gold $4,000 vs Bitcoin $125,000 – Inside 2025’s Epic Safe-Haven Showdown

Gold topped $4,000 per ounce and Bitcoin surged past $125,000 in early October 2025, both setting new records before retreating slightly. A surprise 100% tariff threat by President Trump on Oct. 10 triggered a sharp selloff, sending Bitcoin down to $104,000 and wiping out $20 billion in crypto positions, while gold rose 1.5%. Major banks raised price targets for both assets amid continued volatility.