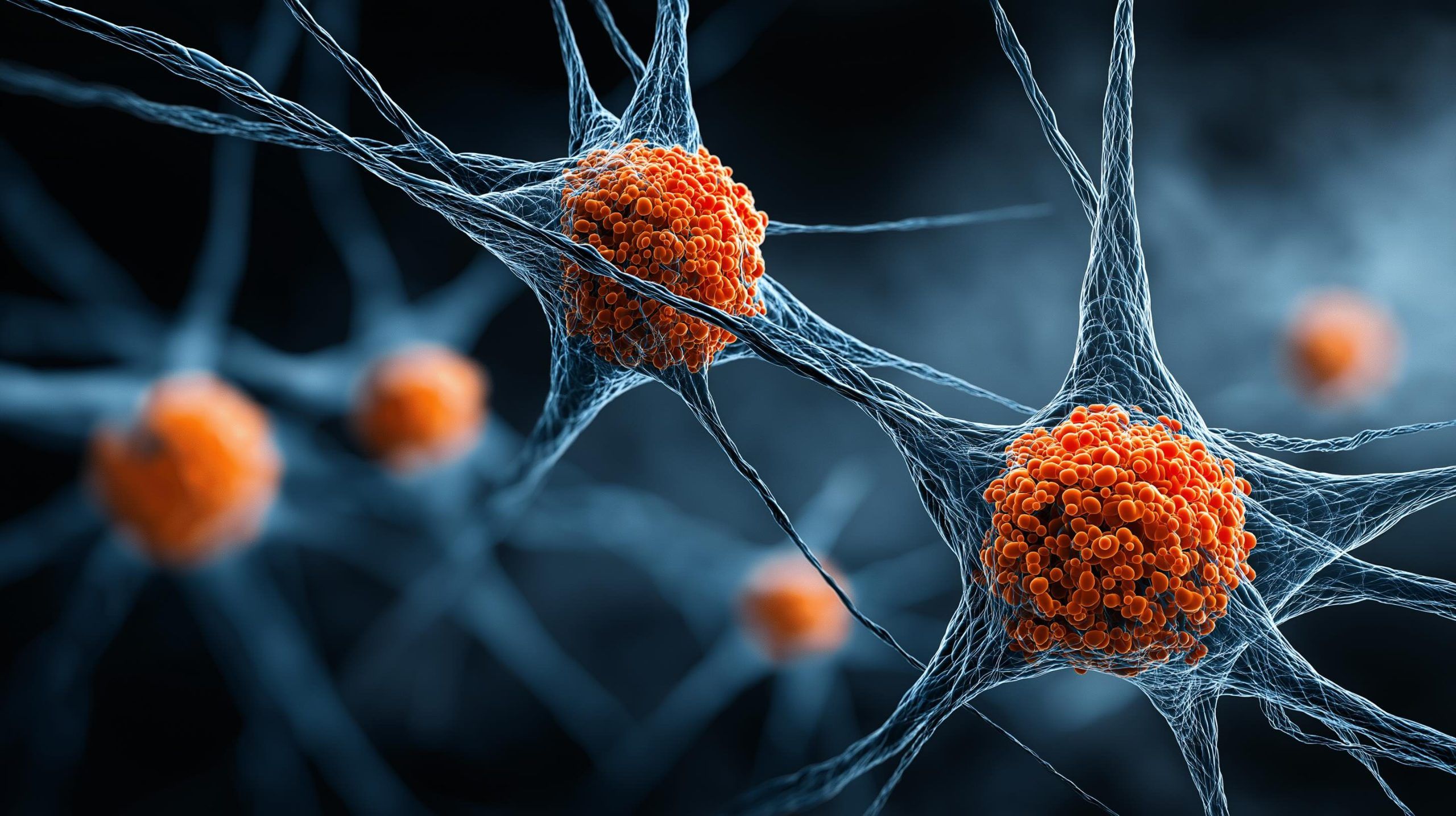

Ozempic for Alzheimer’s? How GLP-1 Weight-Loss Drugs Could Fight Neurodegenerative Diseases

A 2024 trial found liraglutide reduced brain shrinkage by about 50% and slowed cognitive decline in mild Alzheimer’s, but missed its main goal. Larger semaglutide trials are underway, with results expected in late 2025. A major exenatide trial in Parkinson’s showed no benefit, while ALS studies remain inconclusive. Pharmaceutical companies are expanding research into GLP-1 drugs for neurodegenerative diseases.