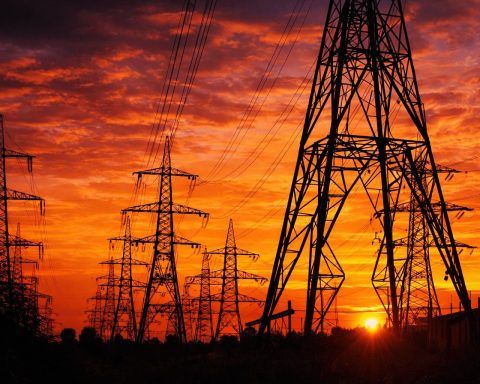

UK energy customers urged to take a year-end meter reading ahead of Jan. 1 price cap change

Go.Compare urged UK households to submit gas and electricity meter readings on Dec. 31 before the energy price cap rises to £1,758 on Jan. 1. The company warned that failing to log readings could lead to billing errors, especially with smart meters that sometimes fail to transmit data. Ofgem set the new cap, up £3 from the previous quarter. Separate reports noted disputes over estimated bills, including cases involving Octopus Energy.