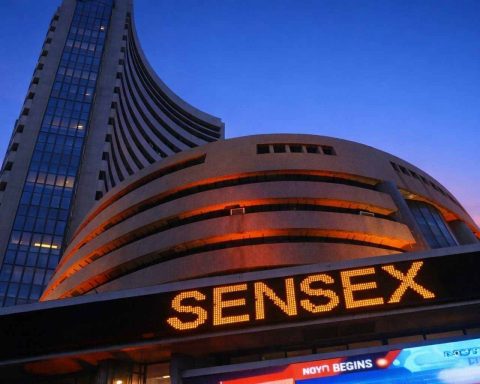

India IPOs today and tomorrow: NSE clears IPO plan; Biopol Chemicals, PAN HR open as Fractal and Aye Finance line up

India’s National Stock Exchange board approved an initial public offering Friday, with existing shareholders set to sell shares. The move comes as four smaller IPOs remain open and two larger deals, including Fractal Analytics, prepare to launch subscriptions next week. NSE posted a 15% quarterly profit rise and a 22.5% jump in derivatives trading for October–December. The Nifty 50 closed up 0.2% at 25,693.70.