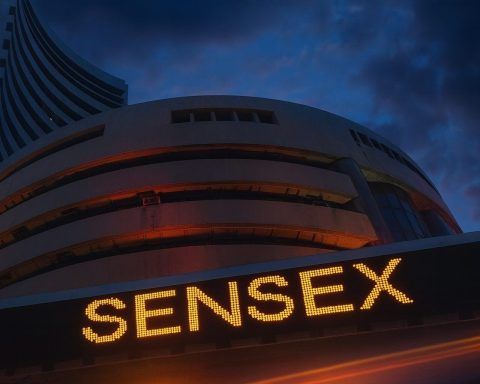

India Economy News Today, December 9, 2025: RBI Rate Cut, 8.2% GDP, Ultra‑Low Inflation and Market Jitters

India’s GDP grew 8.2% year-on-year in July–September 2025, the fastest in six quarters. Inflation dropped to a historic low of 0.3% in October. The Reserve Bank of India cut its repo rate by 25 basis points to 5.25% and announced major liquidity measures. Equity markets remained volatile amid trade tensions with the U.S.