Swiss Stock Market Today, 26 November 2025: SMI Edges Higher as Sentiment Surges and Insurers Face Tougher Rules

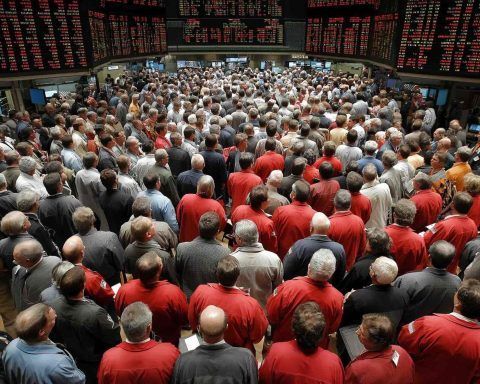

The Swiss stock market added another cautious step higher on Wednesday, 26 November 2025, extending a three‑day recovery but without anything resembling a full‑blown rally. The Swiss Market Index (SMI) closed at 12,781.09 points, up 0.07% from Tuesday’s finish of 12,772.55. That’s the highest level in roughly a week and caps a three-session advance of about 1.0%, after gains of 0.94% on Tuesday and 0.17% on Monday.Investing.com+1 Below the surface, today’s session was shaped by three big themes: Let’s unpack what actually moved Swiss shares today. SMI today: cautious gains after a strong start to the week By late afternoon