NASA News Today, December 4, 2025: Isaacman Hearing, Mars ‘Mini‑Lightning,’ Interstellar Comet, Tsunami from Space and a Cold Supermoon

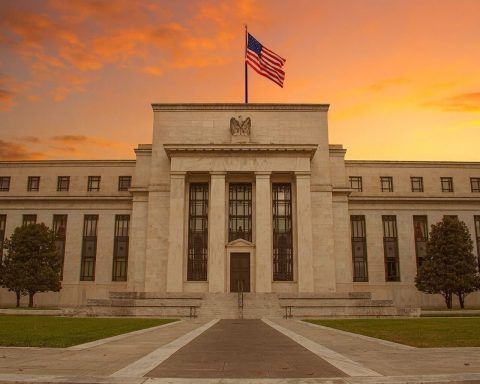

As of Thursday, December 4, 2025, NASA is at the center of a busy news cycle that spans politics in Washington, discoveries on Mars, a new interstellar comet campaign, breakthroughs in tsunami science, fresh Earth imagery, and a sky show dominated by the year’s final supermoon. Here’s a detailed roundup of the key NASA‑related stories shaping the day. 1. NASA Leadership in the Spotlight: Isaacman’s Second Senate Hearing Billionaire entrepreneur and private astronaut Jared Isaacman is once again under the Capitol Hill microscope as President Donald Trump’s nominee for NASA administrator. Isaacman appeared before the Senate Commerce Committee on Wednesday,