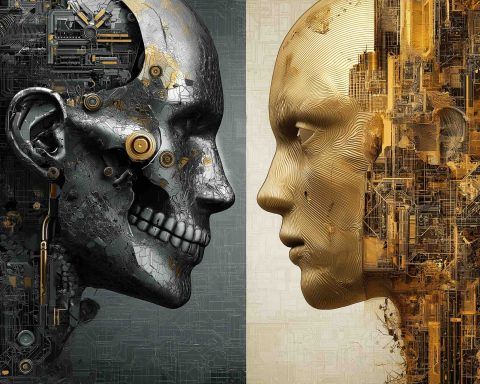

AI Nightmare vs. AI Goldrush: Deepfake Death Threats, Suicides and Mis-ID Arrests Surge — Yet Nvidia, Google & Microsoft Stocks Hit Record Highs

In sum, AI’s dual nature is stark: it’s powering record profits and investments, while also enabling new harms. Experts stress the need to manage the risks – from harassment to bias – even as we ride the economic wave. As Stonehage’s Smit put it, the sector is investing “for the future” while walking a regulatory tightropets2.tech. Investors, meanwhile, are fixated on growth: “the bulls remain fully in charge,” quipped one strategist, as easing rates and strong tech earnings fuel this “AI goldrush”ts2.tech. Sources: Cutting-edge reports and financial analyses from The New York Times, Scripps News, Mind Matters, and market intelligence