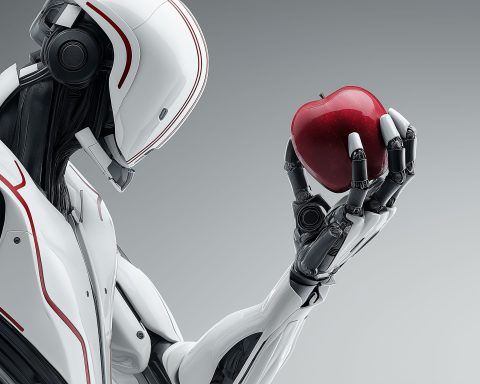

Morgan Stanley: Apple Could Earn $133 Billion a Year From Humanoid Robots by 2040 — As Big as Today’s App Store

Morgan Stanley projects Apple could earn $130–$133 billion annually from humanoid and home robotics by 2040, matching the scale of today’s App Store. The bank expects Apple’s first product, a motorized tabletop home hub, as early as 2027. The report suggests robotics could eventually account for up to a quarter of Apple’s valuation.

![HubSpot (HUBS) Plunges ~18% After Q3 Beat: Raised 2025 Guidance, New AI Push, and Meta’s Clara Shih Joins the Board [Nov. 6, 2025] HubSpot (HUBS) Plunges ~18% After Q3 Beat: Raised 2025 Guidance, New AI Push, and Meta’s Clara Shih Joins the Board [Nov. 6, 2025]](https://ts2.tech/wp-content/uploads/2025/11/HubSpot-Inc-480x384.jpg)