Palantir (PLTR) Stock Skyrockets to Record High as AI Boom Ignites 300% Rally – Could $200 Be Just the Start?

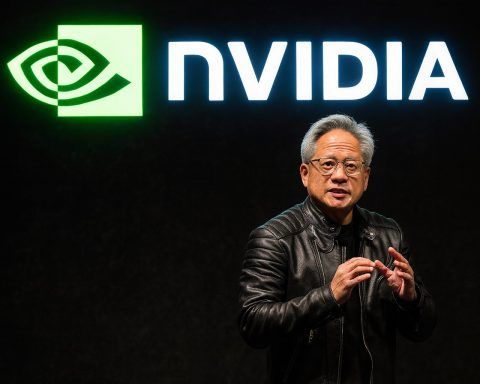

Palantir shares closed at $200.47 on Oct. 31, up about 300% year-to-date, with a market cap near $430 billion. The company secured a 10-year, up-to-$10 billion U.S. Army contract, deals with Lumen and Boeing, and a new NVIDIA partnership. Q2 revenue rose 48% to $1.004 billion, with net income at $327 million. Analysts remain divided; the median 12-month price target is $155–160, below current levels.