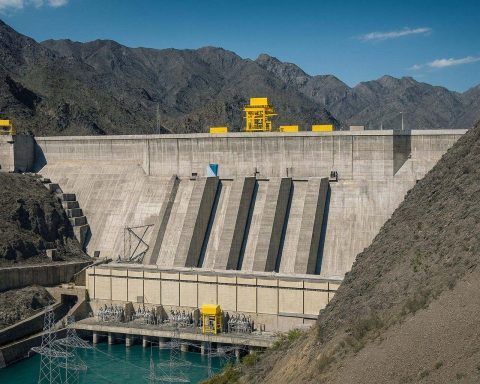

Uzbekistan Launches €9.46 Billion Green Energy Push as Kambarata‑1 Hydropower Funding Set for 2026

Uzbekistan launched a €9.46 billion clean-energy initiative on December 5, including 42 projects for new power plants, battery storage, and grid upgrades. President Shavkat Mirziyoyev said the plan aims to supply the country’s entire annual electricity demand with renewables by 2026, cutting natural gas use by 7 billion cubic metres and emissions by 11 million tonnes.