Sembcorp Industries Ltd Stock (SGX:U96): Share Price, Alinta Deal Impact, Analyst Forecasts and What Investors Are Watching on Dec. 23, 2025

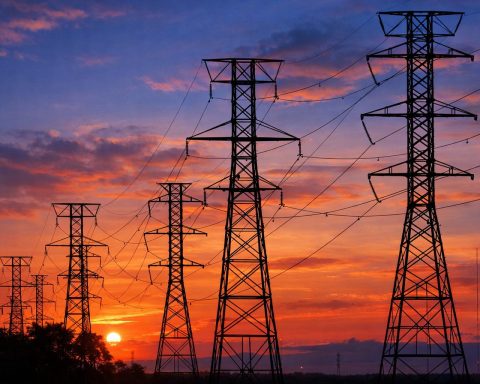

SINGAPORE (Dec. 23, 2025) — Sembcorp Industries Ltd (SGX:U96) is spending late December in a familiar utility-stock paradox: it’s being pitched as a cleaner-energy growth platform because it just agreed to buy an Australian utility that still carries meaningful fossil fuel exposure. The result is a share price caught between two forces — near-term earnings accretion and longer-term transition risk — with analysts splitting on whether the market is being cautious or simply realistic. SG Investors+2MarketScreener+2 Below is what’s driving Sembcorp Industries stock as of 23.12.2025, including the latest company announcements, the most recent broker calls, and where consensus forecasts