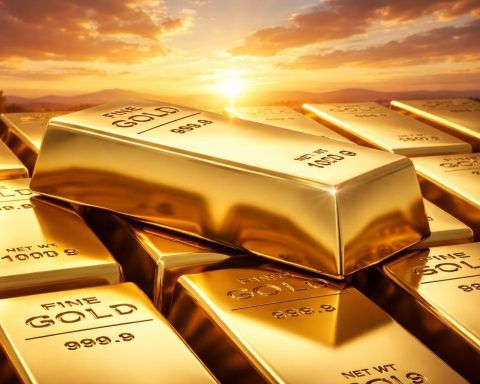

Silver Surges to Record High Near $69/oz as Fed Rate-Cut Bets, Supply Tightness and Geopolitical Risks Fuel Safe-Haven Rush

Spot silver surged to a record $69.23 per ounce on Dec. 22, extending a rally fueled by bets on U.S. rate cuts, tight supply, and geopolitical tensions. Gold also hit an all-time high above $4,390/oz, while Indian silver futures jumped past ₹2.14 lakh/kg. Silver’s year-to-date gain reached about 138%, far outpacing gold’s 67% rise.