Anthropic’s Record-Breaking Rise: $13B Mega-Funding, Big Tech Deals & the AI Showdown in 2025

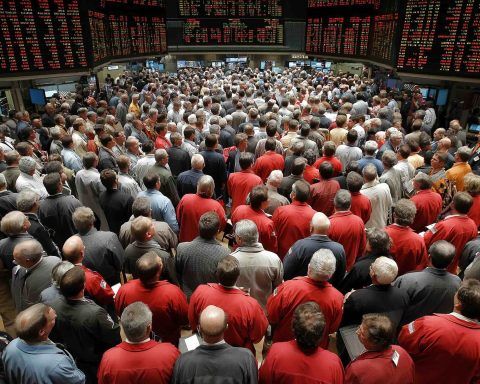

Anthropic raised $13 billion in a September Series F, valuing the AI startup at $183 billion. The company reported over 300,000 enterprise customers and a $7 billion annualized revenue run-rate in October. Anthropic expanded partnerships with Google and Amazon for large-scale AI compute, and launched new Claude 4.5 models and coding tools aimed at business users.