Lithium price steadies after China pullback as Albemarle, SQM shares rise premarket

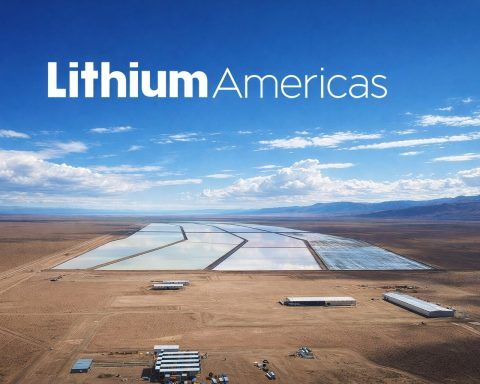

China lithium carbonate futures rose to 137,000 yuan a tonne on Monday, up 4,080 yuan, while spot prices held near 136,000 yuan. Albemarle shares jumped 4.5% in U.S. premarket trading, with Lithium Americas up 5.8%. Producer earnings, including Albemarle’s Feb. 11 report, are in focus after recent price swings.