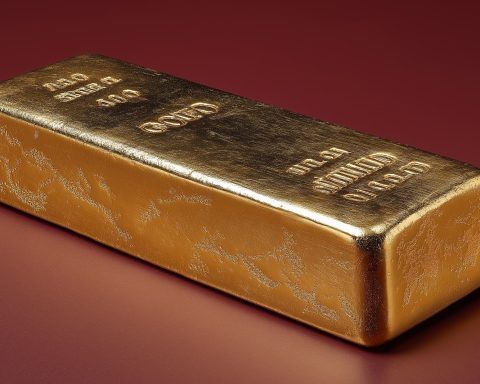

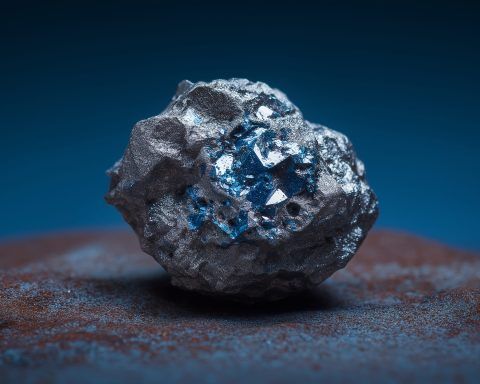

Precious Metals Mania: Gold Smashes $4,000, Silver Soars Past $50 – What’s Driving the Frenzy?

Gold hit a record $4,059 an ounce this week, while silver topped $51.20, its highest since 1980. Both metals then retreated as traders took profits and a Middle East ceasefire eased tensions; spot gold traded near $3,970 and silver around $50.50 on Oct 9. Central banks and ETFs drove demand, while silver faced tight supply. Major banks raised price forecasts, citing ongoing market risks and strong fundamentals.