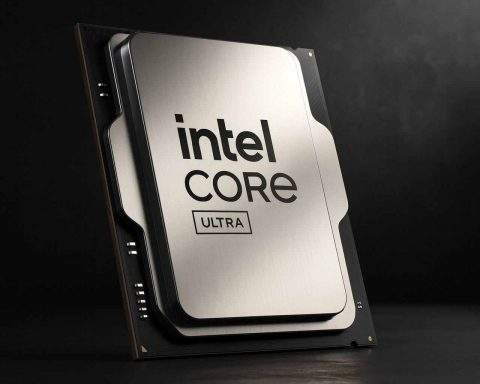

Intel stock slumps 14% in premarket after weak forecast flags AI server-chip pinch

Intel shares fell 14% to $46.69 premarket Friday after warning first-quarter results will miss forecasts due to supply constraints. The company reported Q4 revenue down 4% to $13.7 billion and a GAAP loss of 12 cents per share. Intel expects Q1 revenue between $11.7 billion and $12.7 billion, below analyst estimates. Options trading surged ahead of the drop, with heavy activity in $50 strike puts.