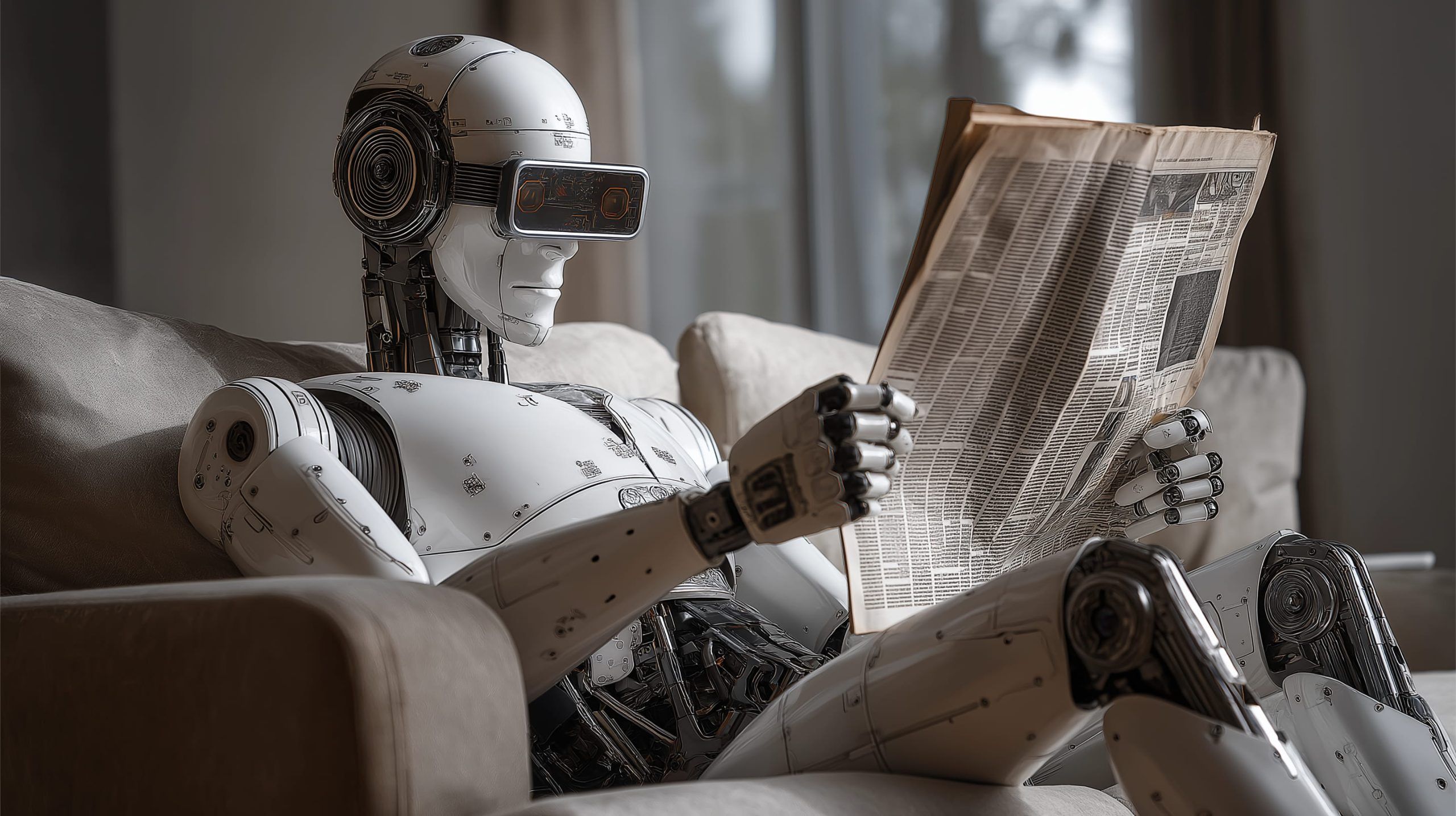

The Next-Gen Robo-Camera Pedestal Shaking Up Studios – MRMC’s RPS‑LT Revealed

MRMC has launched the RPS-LT, a free-roaming studio camera pedestal topped with a 6-axis robotic arm, supporting up to 45 kg broadcast setups. The system uses LiDAR for precise navigation and collision avoidance, outputs real-time FreeD tracking for virtual sets, and can be controlled via MRMC’s Robokam or Flair software.