New York, Feb 20, 2026, 1:14 PM EST — Regular session

- U.S. natural gas futures jumped roughly 5% around midday, snapping back after several sessions of declines. (Investing.com)

- The supply narrative stuck around after storage withdrawals came in lighter than analysts had projected for late February. (EIA Information Releases)

- LNG demand remains in focus as Exxon’s Golden Pass project edges toward its initial output, expected in early March. (Reuters)

Natural gas futures in the U.S. bounced higher on Friday, recouping losses after days weighed down by robust output and mild weather projections.

This shift is catching attention as the market works out how winter wraps up. A single cold snap—or maybe two—could still squeeze supplies, though traders have taken losses on forecasts that suddenly turn mild, leaving gas stocks higher than normal.

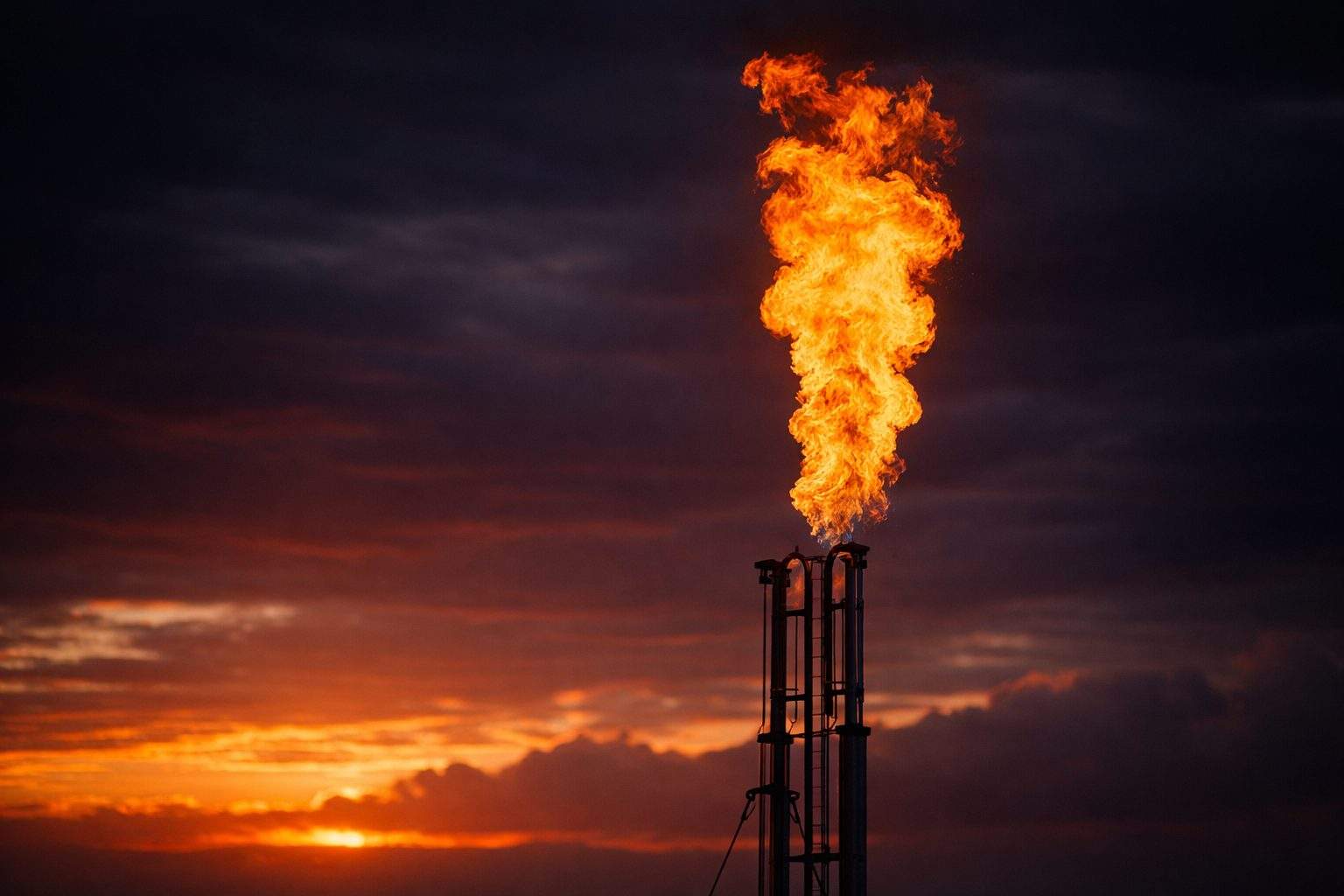

LNG remains a major pressure point. Export plant flows have locked in a persistent floor for U.S. gas, and another wave of demand could hit soon if that much-delayed Gulf Coast facility actually begins shipping out cargoes.

Henry Hub front-month futures climbed 14.5 cents, or 4.8%, to $3.141 per million British thermal units (mmBtu) by early afternoon, according to Investing.com data, after dipping to $2.951 earlier. The leveraged gas ETF BOIL surged roughly 8%, while KOLD, its inverse counterpart, dropped about 8%. (Investing.com)

The U.S. Energy Information Administration on Thursday said storage levels fell by 144 billion cubic feet in the week to Feb. 13, leaving working gas at 2,070 bcf. That’s 59 bcf under last year’s levels and 123 bcf short of the five-year average, according to the agency. (EIA Information Releases)

Storage levels dropped a bit less than traders had expected, with the market looking for a 148 bcf pull, per Investing.com’s economic calendar. (Investing.com)

Supply has kept pressure on the market. LSEG estimates Lower 48 production is averaging 108.6 billion cubic feet per day this February—still close to the record set in December, Reuters reported Thursday. (Business Recorder)

Short-covering ahead of the weekend and a fleeting cold snap in the East were on traders’ minds. “It appears that short sellers were covering ahead of the weekend,” wrote FXEmpire analyst James Hyerczyk. He highlighted weather and LNG export demand as the central themes moving the market. (FXEmpire)

Exxon Mobil chief Darren Woods told analysts he’s looking for the first LNG to come out of the Golden Pass plant—a partnership with QatarEnergy—in March. “My expectation is we will see first LNG produced in very early March,” Woods said during Exxon’s earnings call, according to Reuters. (Reuters)

The downside risk still looms. Should late-February warmth return and output remain strong, traders say the market could slide into the spring “shoulder season”—that period between winter heating demand and the summer cooling push—without much incentive to chase prompt gas higher.

The EIA’s weekly storage numbers land Thursday, Feb. 26. Traders are also watching for late-winter weather developments and any signs that feedgas volumes into Golden Pass continue their climb heading into March.