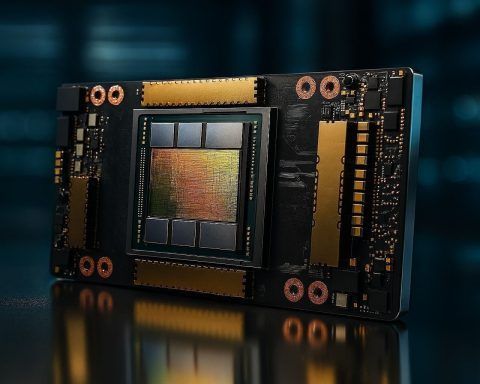

AI stocks swing hard: Nvidia jumps as Amazon slides on $200 billion AI spend

Nvidia jumped 7.3% and AMD rose 7.7% Friday, lifting the Philadelphia SE Semiconductor Index by 4.6%. Amazon fell 7% after announcing a $200 billion capital expenditure for 2026, far above expectations. Arm Holdings gained 9.8% despite a licensing revenue miss. Investors pulled $2.34 billion from tech funds for the week ending Feb. 4, LSEG Lipper reported.