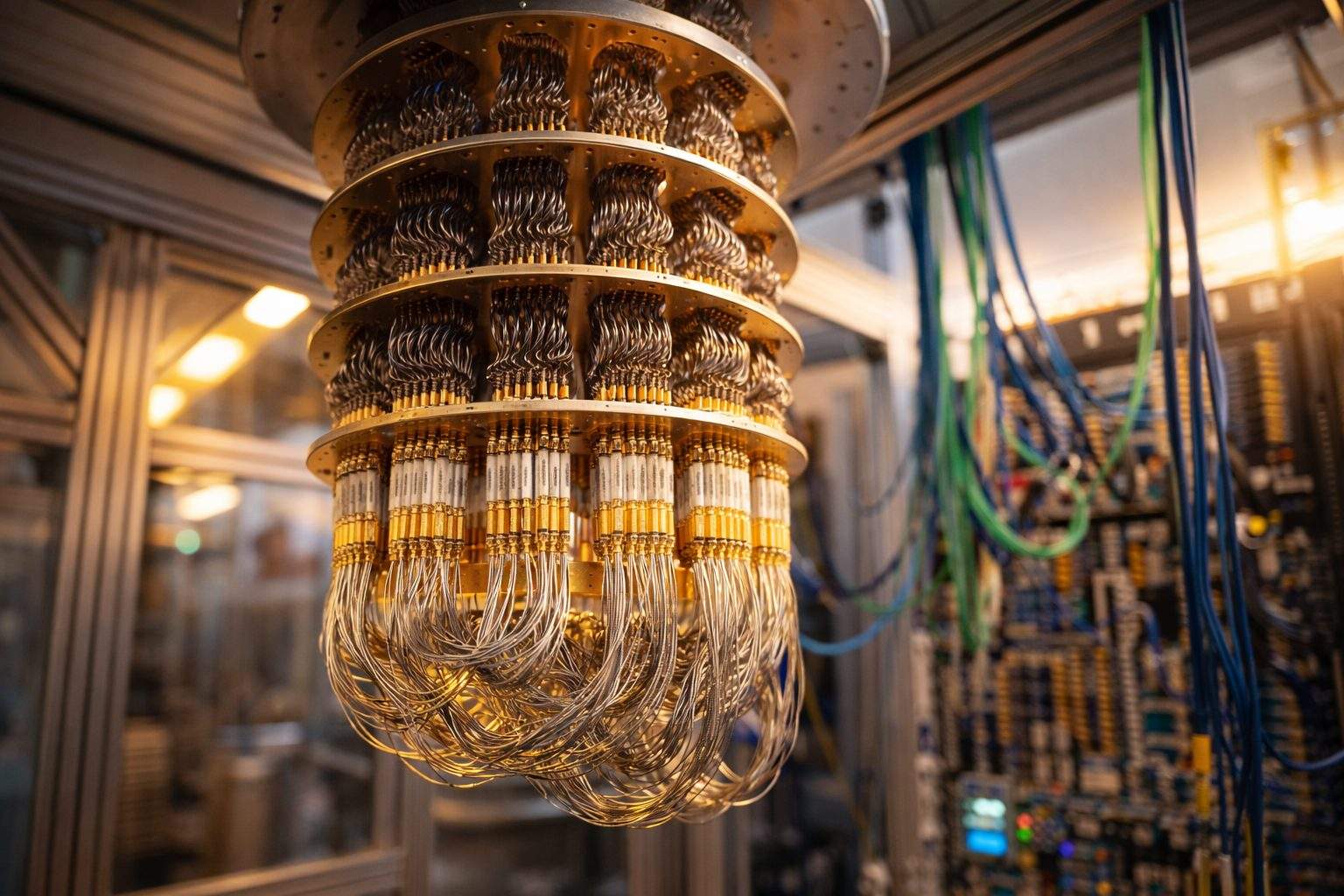

Quantum computing stocks bounce hard: IonQ, Rigetti, D‑Wave rally as traders reset for a data-heavy week

IonQ, Rigetti, D‑Wave, and Quantum Computing Inc shares surged 15–21 percent Friday, erasing losses from the previous session. The rebound followed a Wall Street rally that sent the Dow above 50,000 for the first time. IonQ remains under scrutiny after a short-seller report questioned its Pentagon contract revenue. Investors await delayed U.S. jobs and inflation data next week.