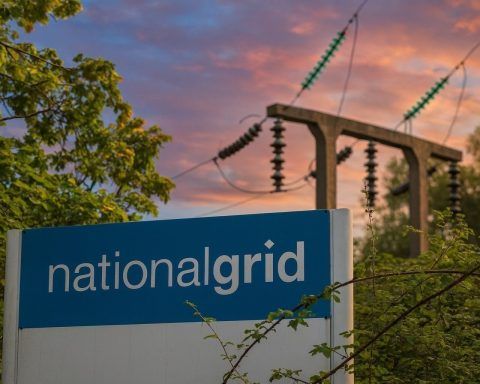

National Grid share price falls today: why NG.L is sliding and what investors watch next

National Grid shares fell 0.8% to 1,148.5 pence in early London trading Monday, lagging the FTSE 100’s 0.4% gain. No new company news was reported, with traders focused on interest-rate expectations ahead of the Bank of England’s Feb. 5 policy meeting. National Grid’s interim dividend is due Jan. 13. About 1.18 million shares changed hands by 08:17 GMT.