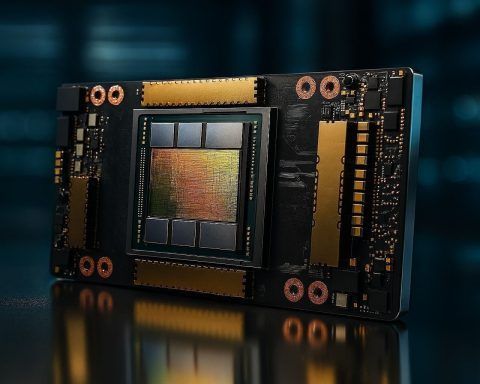

Arm Holdings stock rallies into weekend on AI spending hopes — Monday’s next test

Arm Holdings’ U.S. shares jumped 11.6% Friday to $123.70, capping an 18% two-day rebound amid a rally in chip stocks tied to AI data-center spending. The gains followed Arm’s fiscal Q3 revenue beat, but executives warned memory shortages could cut royalty revenue by up to 2% as smartphone chip shipments are expected to fall 7% in 2026. Investors now await Arm’s “Arm Everywhere” event on March 24.