OpenAI’s Mega AMD Deal: How a 6‑Gigawatt AI Chip Alliance Could Reshape the Arms Race

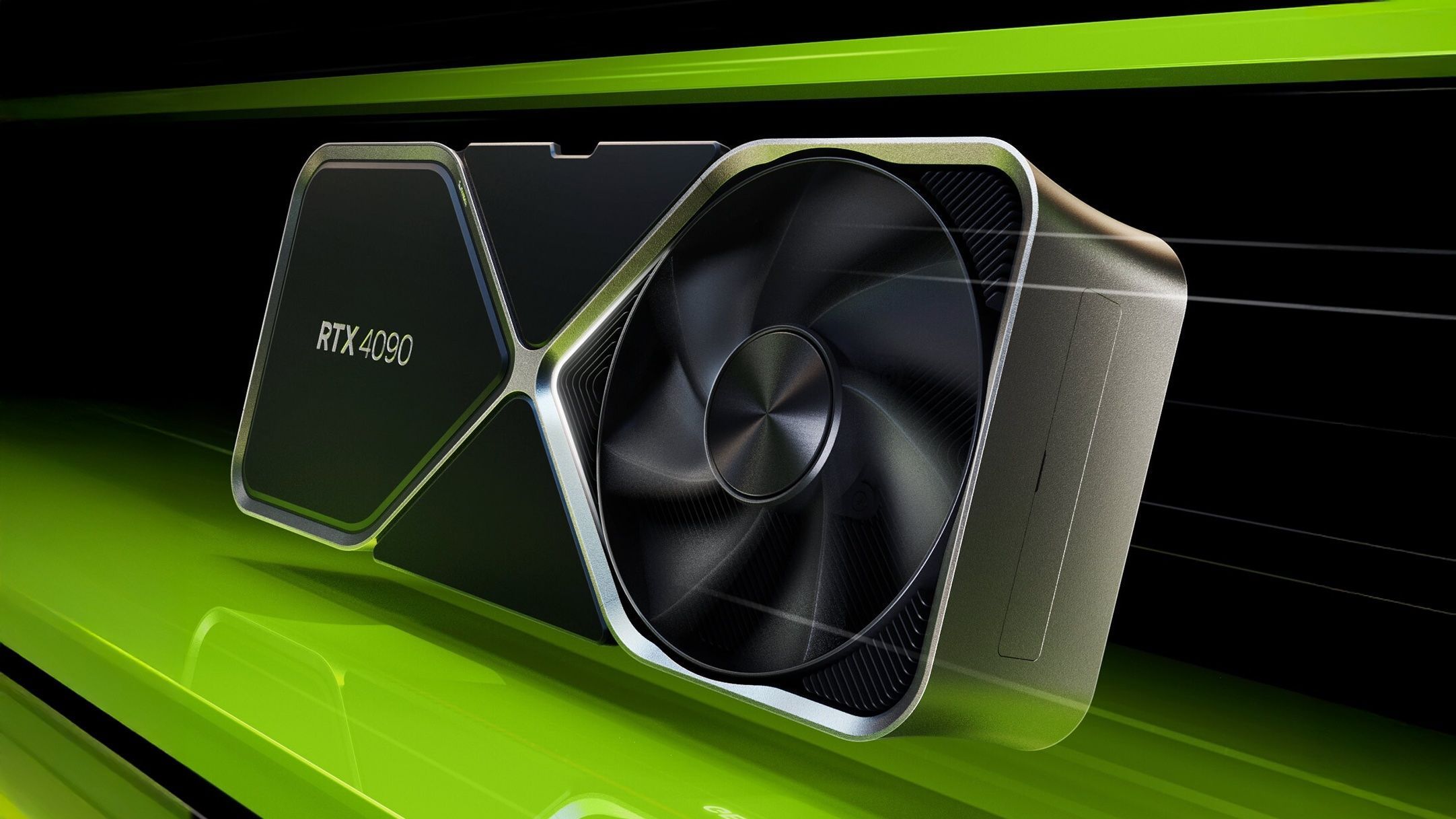

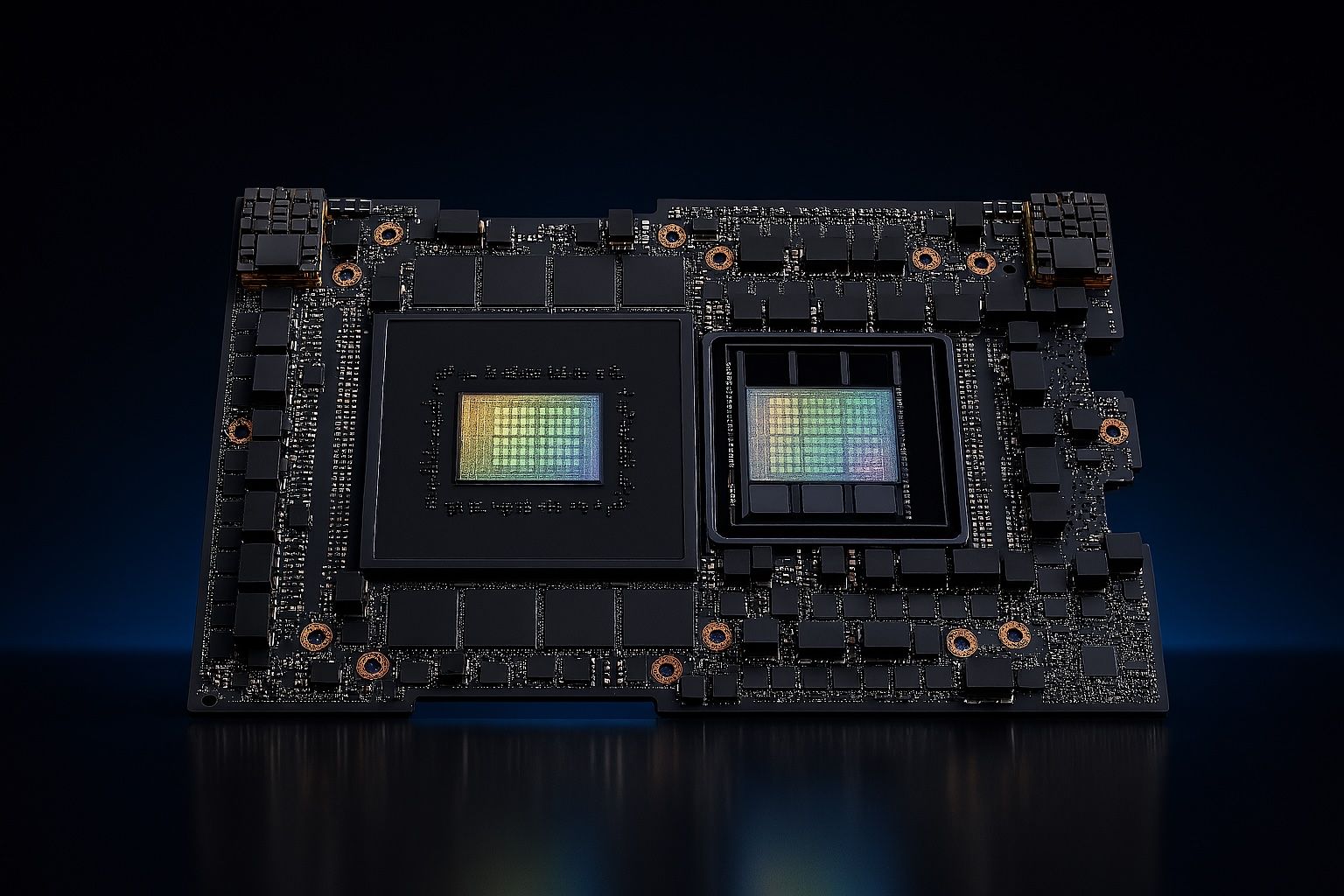

OpenAI and AMD announced a multi-year deal on Oct. 6, 2025, for OpenAI to deploy six gigawatts of AMD GPUs, starting with one gigawatt of MI450 chips in late 2026. AMD granted OpenAI a warrant for up to 160 million shares at $0.01 each, potentially giving OpenAI a 10% stake if milestones are met. AMD expects over $100 billion in revenue over four years. AMD shares rose more than 23% after the news.