Stock Market Today (Nov. 18, 2025): Nasdaq slides as AI trade stumbles; Tesla, Palantir, SMCI pace tech losses ahead of Nvidia earnings; Disney ends YouTube TV blackout

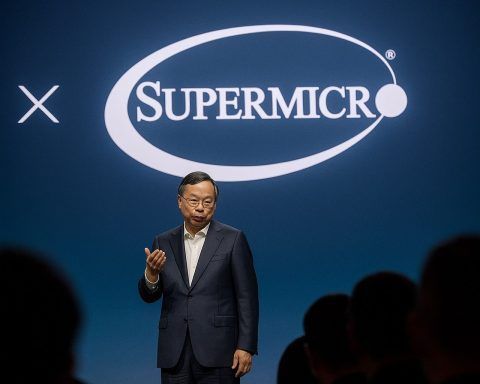

U.S. stocks fell for a fourth straight session Tuesday, with the Dow down nearly 500 points intraday and the Nasdaq off up to 1.5% as investors sold AI-linked shares and weighed fading odds of a December Fed rate cut. Tesla, Palantir, and Super Micro Computer posted notable declines. Nvidia’s earnings report Wednesday looms, with options markets bracing for a 7% swing. A Cloudflare outage briefly disrupted major tech services, adding to sector jitters.