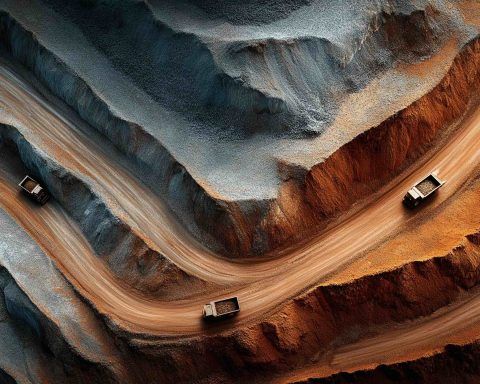

US Government Takes 5% Stake in Lithium Americas – LAC Stock Soars

The U.S. Department of Energy will take a 5% equity stake in Lithium Americas and a separate 5% stake in its Thacker Pass lithium mine joint venture with GM, Energy Secretary Chris Wright confirmed. Lithium Americas shares jumped nearly 90% on initial reports of the deal. The DOE stake coincides with talks to renegotiate a $2.26 billion government loan for the Nevada project. Thacker Pass could boost U.S. lithium output by 40,000 tonnes per year.