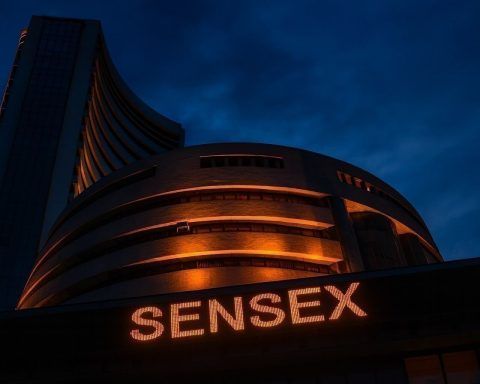

Asia Stock Market Today (Dec. 16, 2025): Asian Shares Slide as Tech Sells Off Ahead of US Jobs Data and BOJ Rate Call

Asian stocks closed mostly lower Tuesday, with MSCI’s Asia-Pacific index outside Japan down 1.45% to a three-week low as tech shares led declines. Japan’s Nikkei 225 dropped 1.6% amid Bank of Japan rate hike speculation. Weak Chinese economic data, property debt concerns, and falling oil prices added pressure. Investors awaited key U.S. jobs and inflation reports and central bank decisions later in the week.