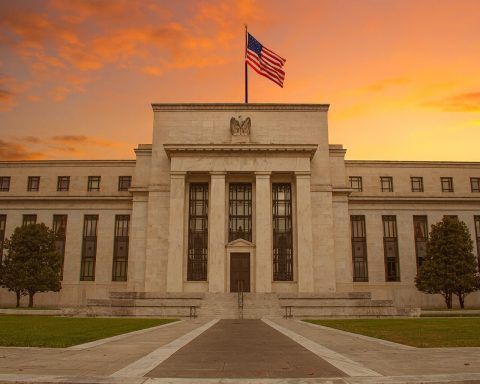

US PPI Rises 0.3% in September as Energy Costs Jump: What the Delayed Inflation Report Means for the Fed on November 25, 2025

The US Producer Price Index rose 0.3% in September, led by a 3.5% jump in energy costs, after a 0.1% drop in August. Core PPI, which excludes food, energy, and trade services, increased just 0.1%. Wholesale food prices climbed 1.1%, while services prices were flat. Annual producer inflation held steady at 2.7%.