Big Tech Stocks Today: Magnificent Seven Slide After AI Funding Jitters Hit the Nasdaq (Dec. 17, 2025)

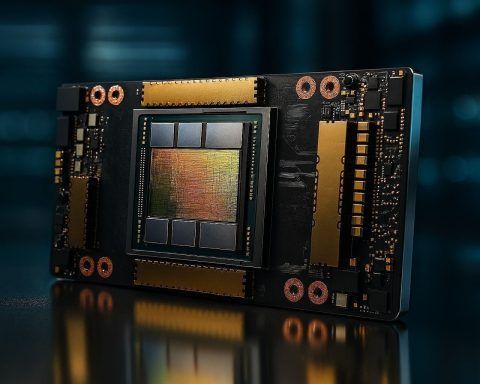

Big Tech stocks fell sharply Wednesday, with the Nasdaq down 1.8% and the S&P 500 off 1.2%, as renewed doubts over AI infrastructure financing triggered heavy selling. Nvidia slid 3.7%, Tesla lost 4.6%, and Alphabet dropped 3.2%. Oracle’s Michigan data-center project and questions over funding terms fueled market anxiety. Broadcom also tumbled about 4.5% amid continued volatility.