Micron Technology (MU) Outlook 2026: Record Q1 Earnings, AI Memory Shortage, and the Latest Analyst Forecasts (Dec. 25, 2025)

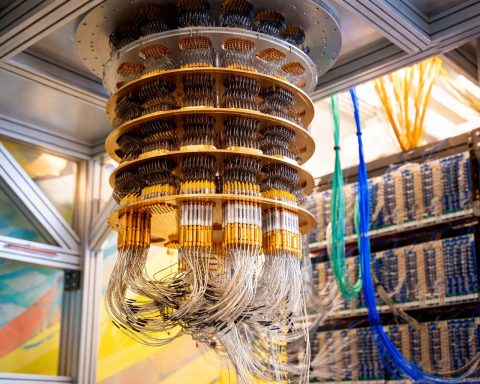

Micron Technology reported record fiscal Q1 2026 revenue of $13.6 billion, up 57% year over year, and issued guidance for Q2 that exceeded Wall Street expectations. The company raised fiscal 2026 capital spending to about $20 billion and said its entire 2026 supply of high-bandwidth memory is sold out. Analysts raised price targets, with Rosenblatt setting a $500 target. Micron shares surged following the December 17 earnings release.