Shocking Showdown: How Iran Is Trying to Snuff Out Elon Musk’s Starlink—and Why Tens of Thousands of Dishes Keep Beaming Freedom Back

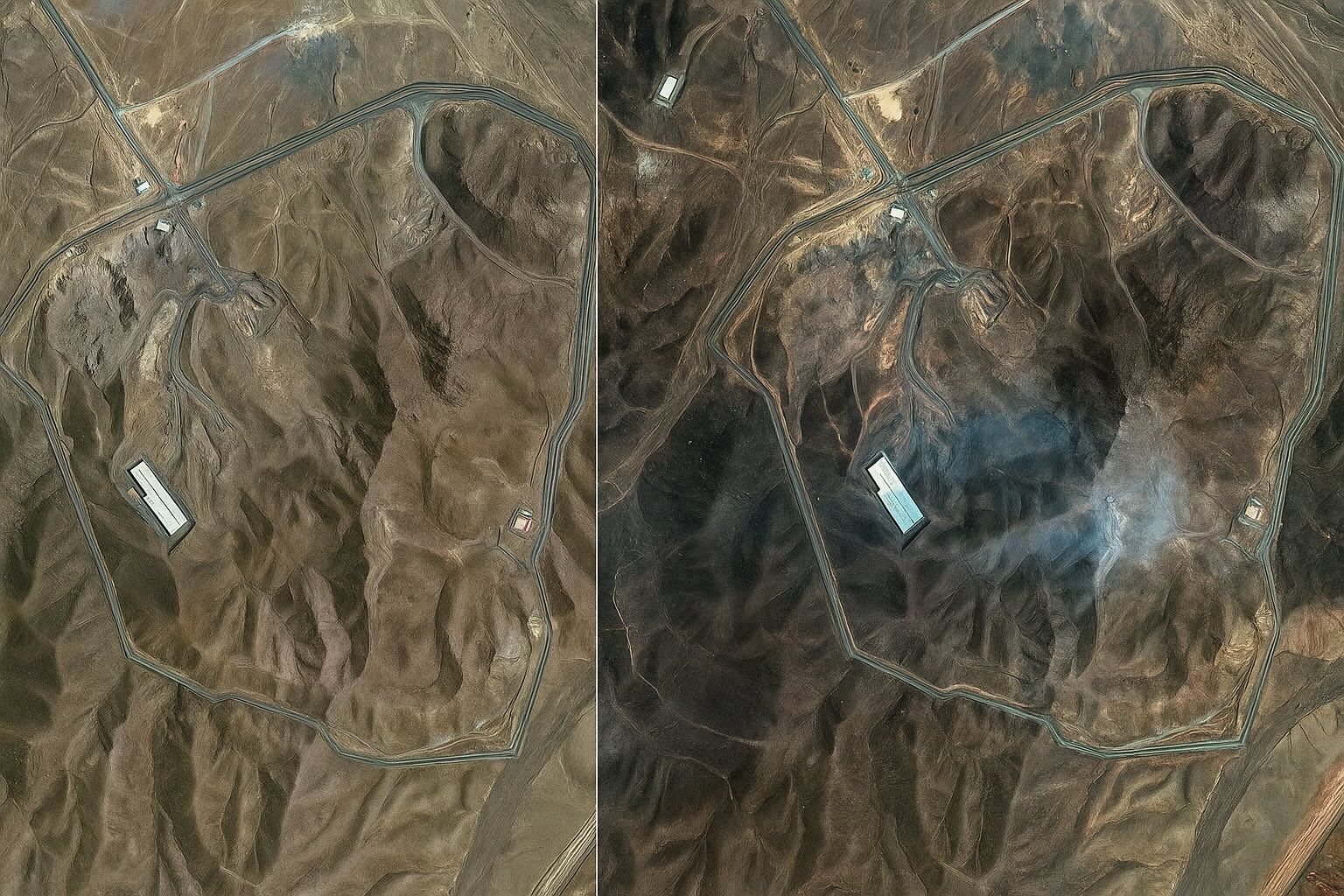

Iran’s Ministry of Communications warned on 23 June 2025 that owning or installing a Starlink terminal is a punishable offense and urged the ITU to force SpaceX to deactivate unauthorized devices. Internet connectivity in Iran fell by 97 percent after Israel’s Operation Rising Lion on 13 June. Starlink coverage was restored over Iran on 14 June, with an estimated 20,000 smuggled dishes in use. Parliament is moving to classify illegal satellite gear as espionage tools.