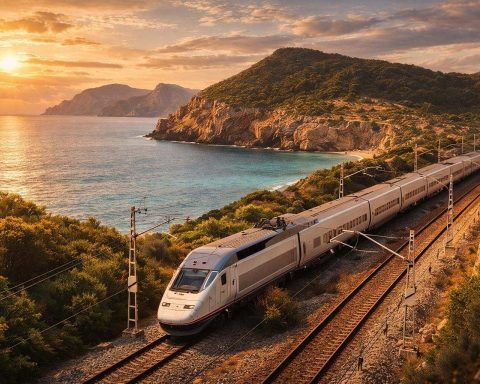

Spain’s €60 Nationwide Transport Pass Starts 19 January 2026: What’s Included, What’s Not, and How It Compares Across Europe

Spain will launch a nationwide public transport pass on January 19, 2026, priced at €60 per month for adults and €30 for those under 26. The pass will cover state-managed services including Renfe commuter and regional trains and state-run intercity buses, but will not include high-speed AVE trains or most local metro, tram, and city bus networks at launch.