International stocks beat Wall Street in 2025 — and the funds that outperformed in both the drop and the rebound

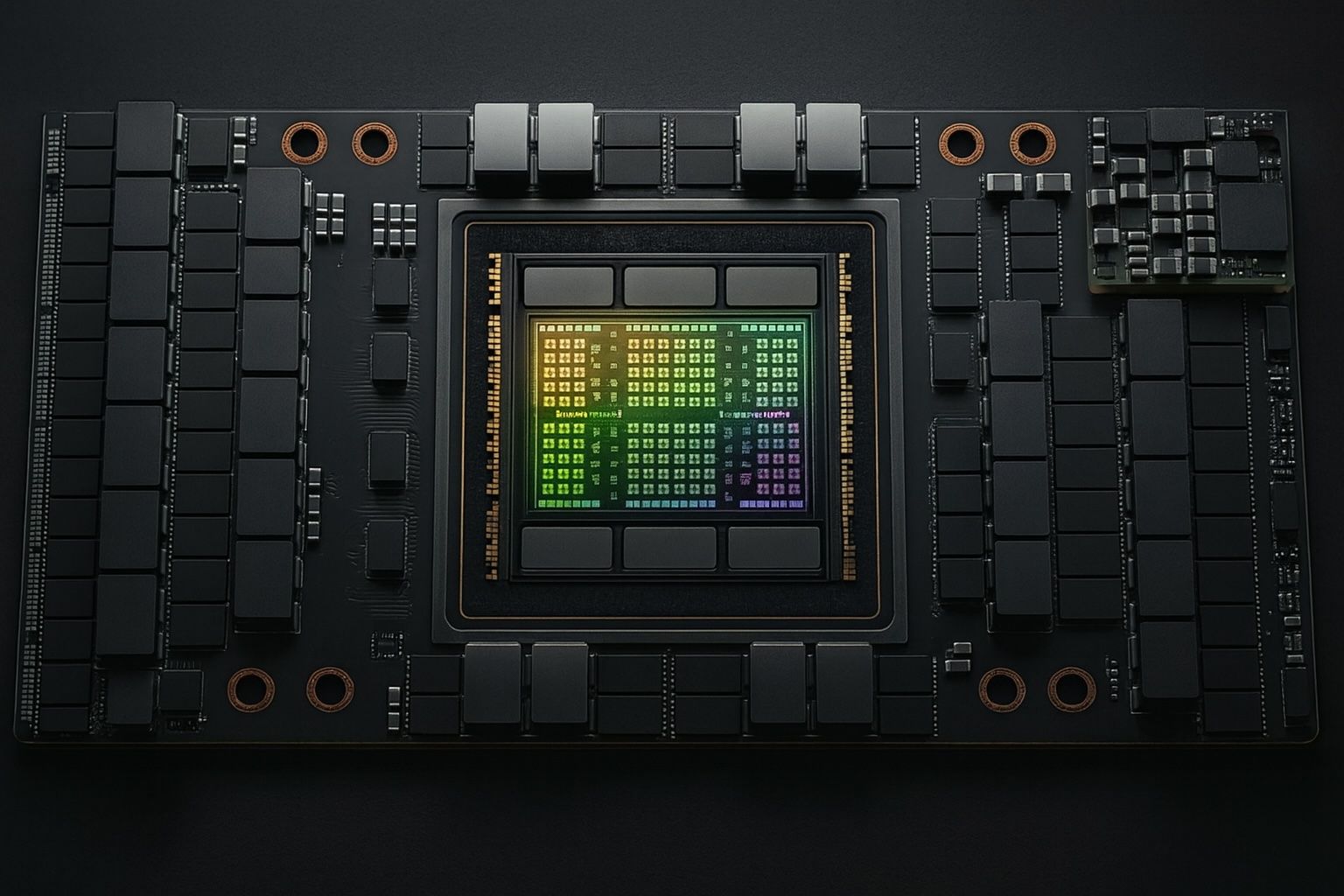

Non-U.S. stocks surged 29% in 2025, their best year since 2009, outpacing the S&P 500’s 17% gain, according to Al Jazeera. South Korea’s KOSPI jumped nearly 76%, with SK Hynix and Samsung Electronics soaring on AI chip demand. Europe’s FTSE 100 and DAX 40 rose over 20%. The U.S. dollar fell about 10% as tariffs climbed, Reuters reported.