‘Vineland ramp’ or bust? Nebius’ Q3 countdown, Microsoft mega‑deal and stock‑split buzz — what investors need to know now

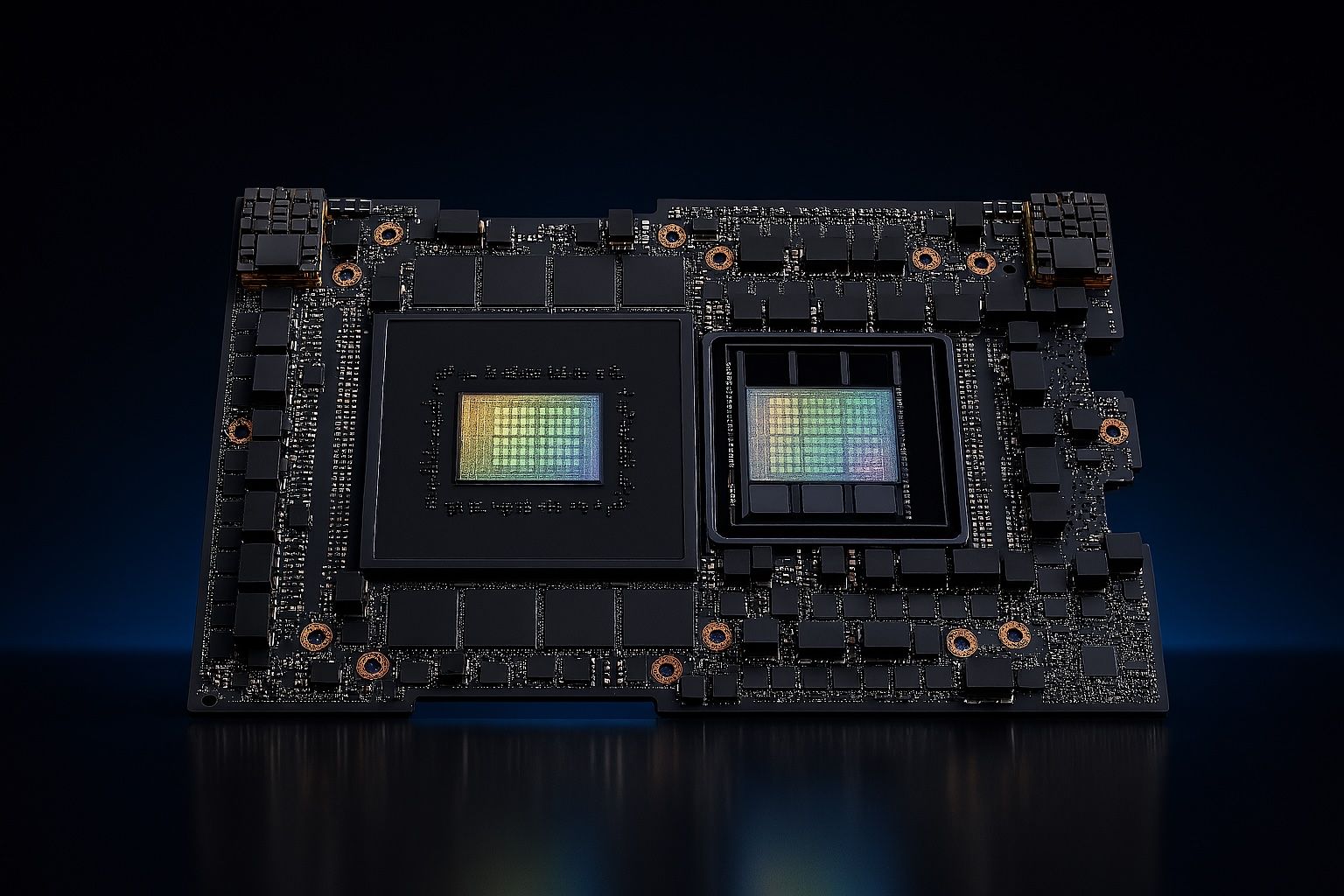

Nebius Group N.V. (NASDAQ: NBIS) will report Q3 results Tuesday, Nov. 11, before market open. Shares traded near $110.54, down about 8% intraday and off 15.5% over five days, but remain up roughly 300% year-to-date. Investors focus on the Vineland, NJ data-center build and timing of revenue from a $17.4B Microsoft AI-infrastructure contract starting later this year.