![Plug Power (PLUG) Today: Q3 Results Set the Stage for a $275M Liquidity Pivot, Data‑Center Push, and Fresh Analyst Calls [Nov 11, 2025] Plug Power (PLUG) Today: Q3 Results Set the Stage for a $275M Liquidity Pivot, Data‑Center Push, and Fresh Analyst Calls [Nov 11, 2025]](https://ts2.tech/wp-content/uploads/2025/11/Plug-Power-Inc.-PLUG-1-480x384.jpg)

Plug Power Stock Today (November 17, 2025): PLUG Slides Again as Leadership Shake‑Up, DOE Cuts and AI Pivot Collide

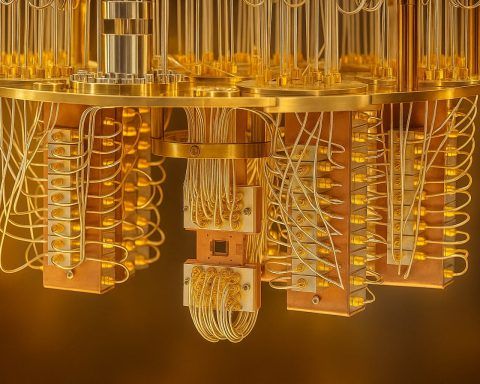

Plug Power shares fell about 5.7% in European trading Monday after a 15% drop last week, following deep Q3 losses and a leadership shakeup. The stock closed Friday at $2.25, down more than 50% from its October peak. Q3 revenue rose 1.9% to $177.1 million, but net loss widened to $363.5 million. Operating expenses nearly doubled, driven by impairment and restructuring charges.