Wall Street Hits Record Highs as Tech Stocks Soar and Shutdown Worries Melt

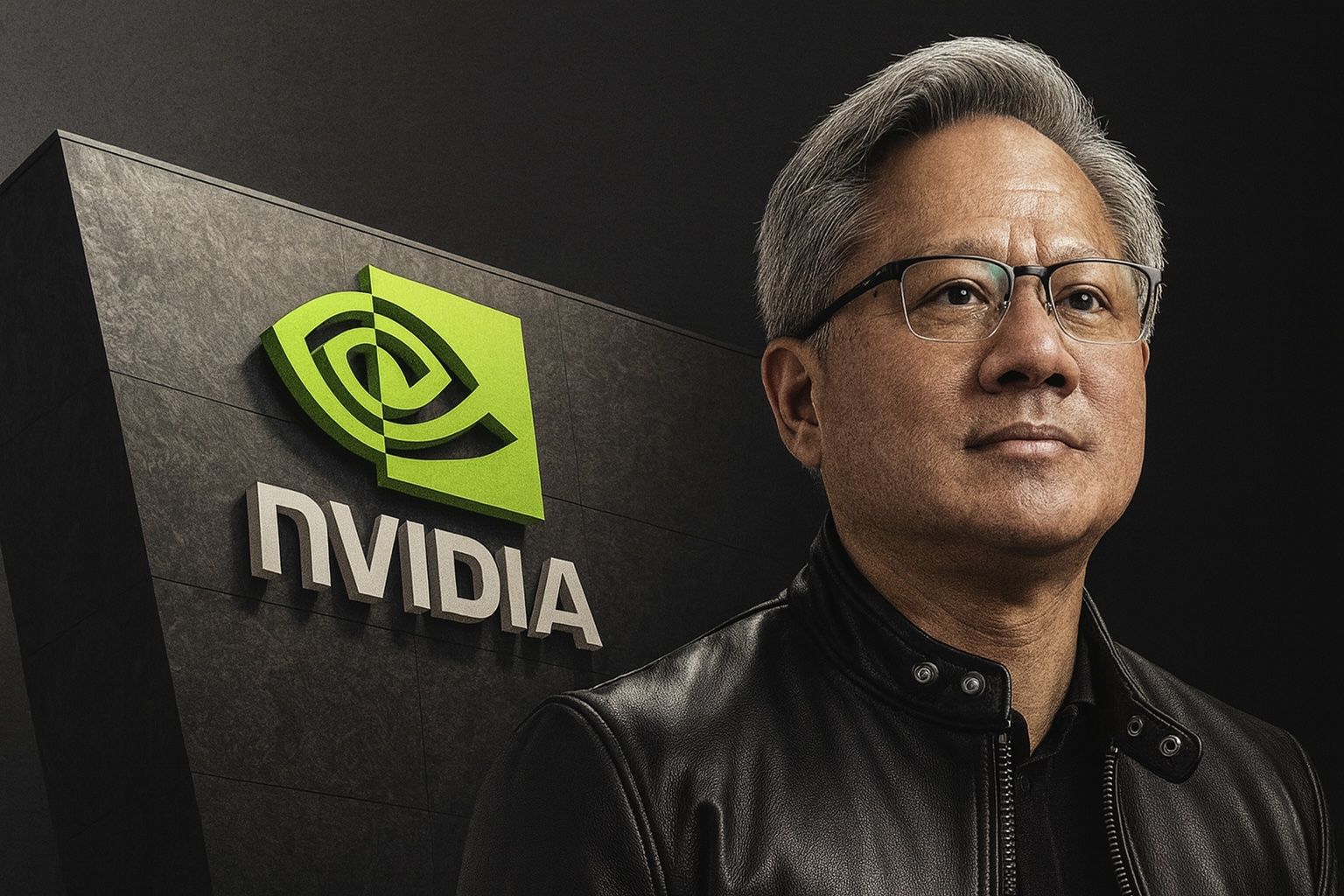

The Dow, S&P 500, and Nasdaq all closed at record highs on Oct. 2–3, led by gains in technology and AI stocks. Tesla fell 5% despite strong Q3 deliveries, while Stellantis jumped up to 8% on robust U.S. sales. A federal shutdown delayed key economic data, fueling bets on Fed rate cuts. OpenAI’s funding round implied a $500 billion valuation, boosting AI enthusiasm.