Elon Musk’s Starlink vs. Iran’s Blackout: Fact-Checking the 20,000 Secret Dishes Reconnecting a Nation

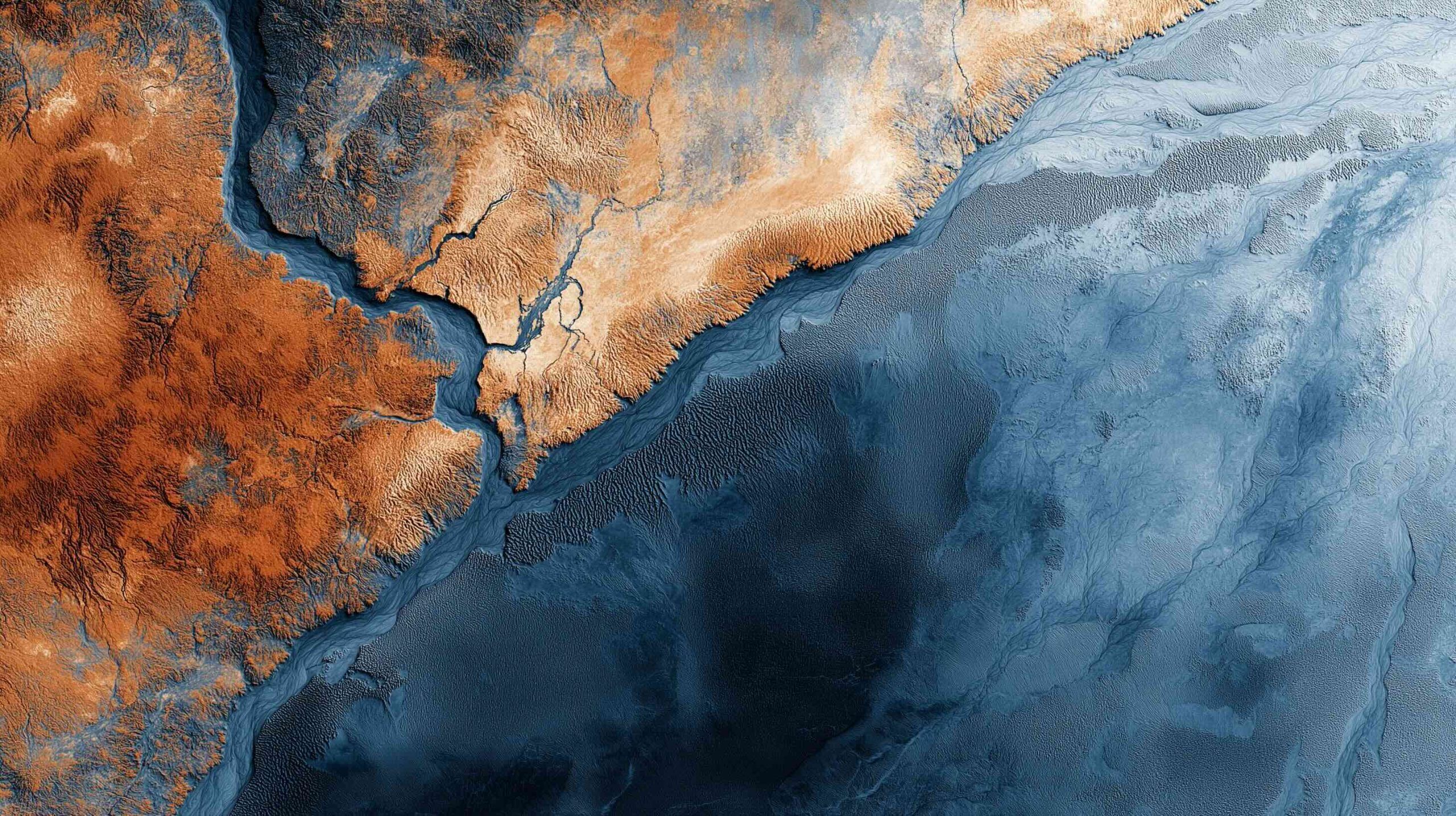

After Israeli strikes on June 14, 2025, Iran imposed a nationwide internet blackout. Elon Musk announced Starlink activation over Iran, but only users with Starlink terminals gained access. By early 2025, estimates put clandestine Starlink terminals in Iran between 10,000 and 20,000. Black market prices for kits reached $2,000, while the average monthly salary was about $250.