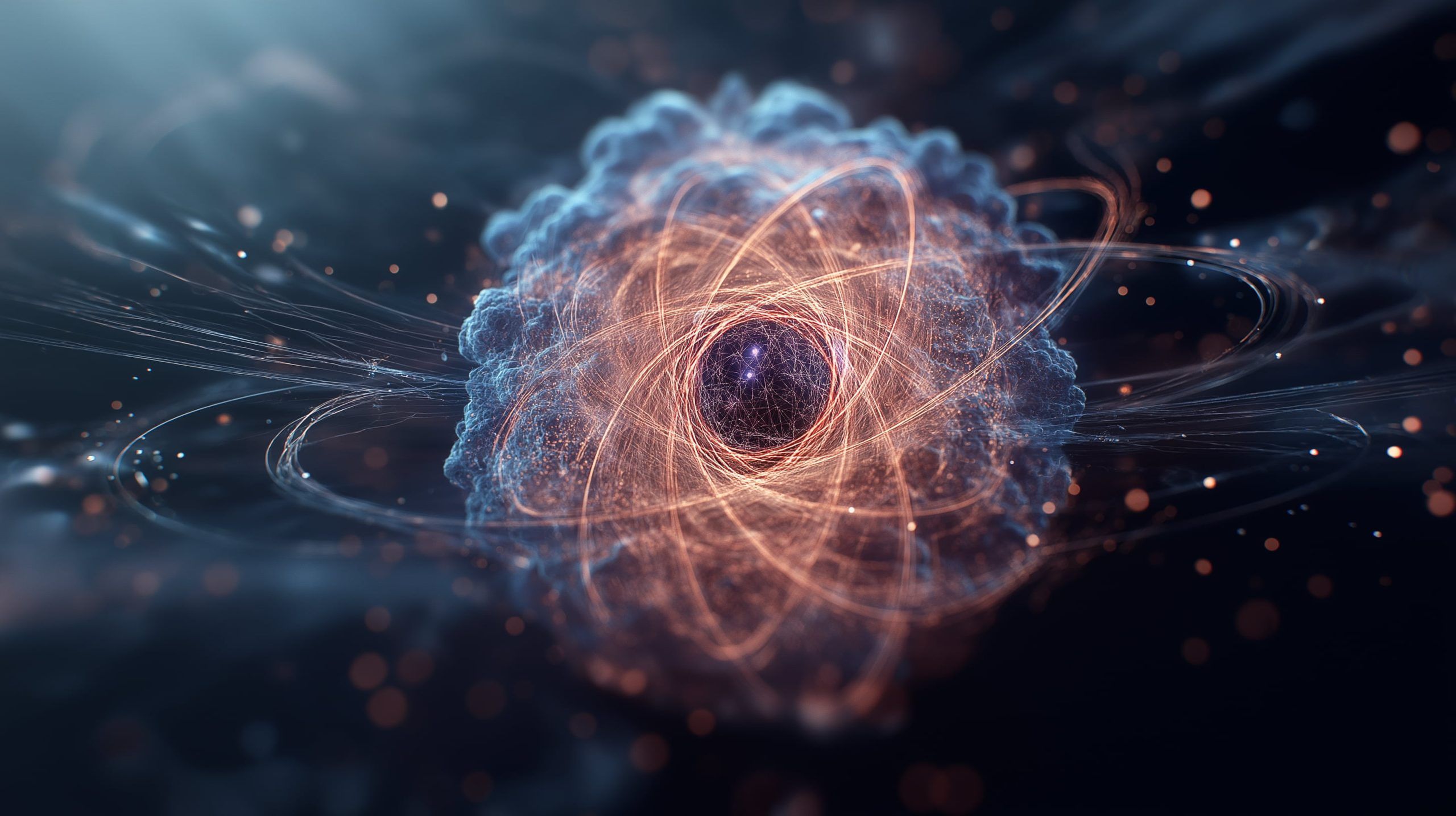

Don’t Miss This Weekend’s Cosmic Light Show: Meteors, Auroras & 5-Planet Parade on Aug 29–30, 2025

A rare Black Moon this week left skies unusually dark on Aug 29–30, aiding stargazing. The Aurigid meteor shower peaks around Sept 1 with up to 10 meteors per hour possible. All five naked-eye planets are visible this weekend, with Mars low after sunset and Saturn shining all night. Aurora sightings were possible at high latitudes Aug 27–28 after solar flares, but geomagnetic activity is now quiet.