Uber stock jumps nearly 6% as CES robotaxi reveal with Lucid, Nuro lifts shares

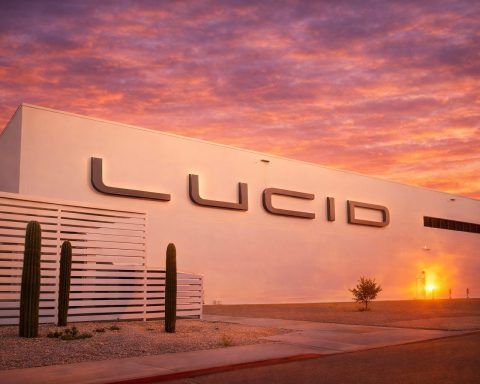

Uber shares jumped 5.9% to $85.54 in after-hours trading Tuesday after unveiling a Lucid-based robotaxi with Nuro at CES. The vehicle uses Nuro’s Level 4 self-driving system and Nvidia hardware, with on-road testing underway in the Bay Area. Production is expected later this year at Lucid’s Arizona plant, pending validation. Investors are watching for updates on rollout timing and partnership economics.