Space News Today: Global Advances, Challenges, and New Frontiers / Updated: 2025, July 7th, 12:00 CET

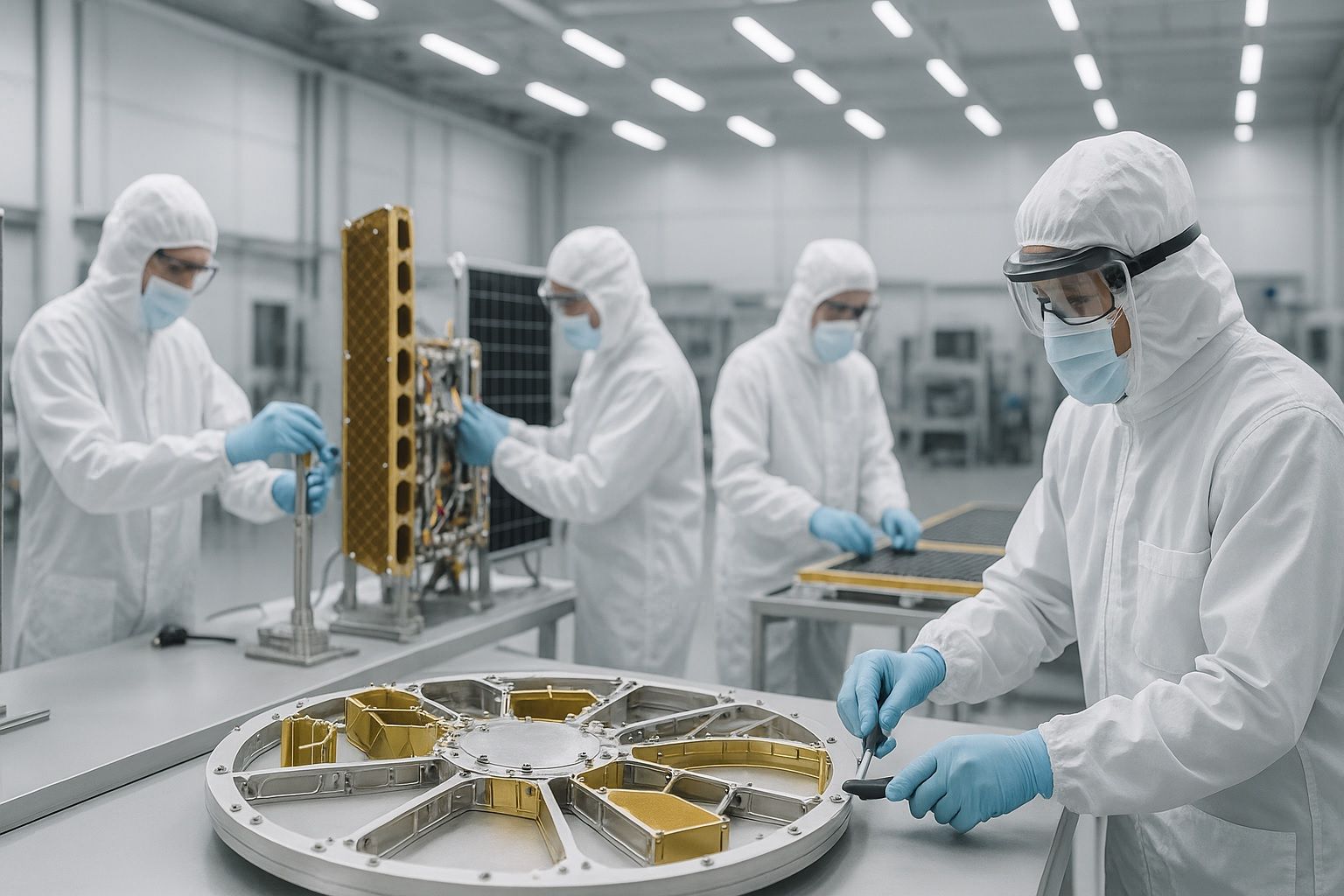

Boeing won a $2.8 billion contract to develop next-generation nuclear communications satellites for the U.S. military. SpaceX’s Starlink now makes up over 60% of all active satellites after recent launches. Spain’s Hisdesat will launch SpainSat NG II in October with NATO as its first client. SpaceX plans a $1.8 billion Starlink facility in Florida, creating 600 jobs by 2030.