Uzbekistan’s Internet Makeover: Blazing Speeds, New Satellites, and Lingering Barriers

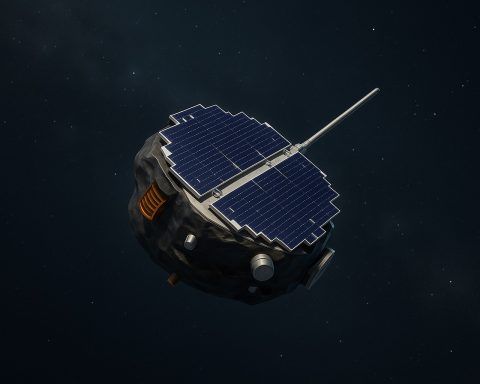

Uzbekistan had 29.5 million internet users in January 2024, covering 83.3% of the population. Uztelecom expanded fiber and boosted international capacity to 3.2 Tbps in 2022, while 5G rollout began in 2023. A 2024 law set up an independent telecom regulator. Starlink received a license in late 2024 but is not expected to launch before 2025.