Space Race Heats Up: Record Rocket Launches, New Alliances & a Visitor From Beyond – Space News Roundup (Oct 3–4, 2025)

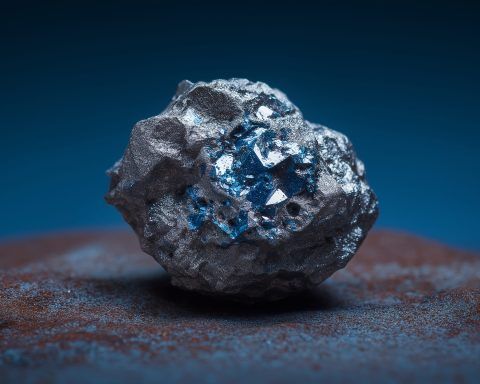

SpaceX launched its 125th Falcon 9 mission of 2025 on Oct. 3, breaking Vandenberg’s annual launch record and sending 28 Starlink satellites into orbit. The U.S. Space Force awarded over $1 billion to SpaceX and ULA for seven national security launches the same day. NASA operations were pared back due to a government shutdown, but ISS crews continued work. Interstellar comet 3I/ATLAS passed Mars, with NASA and ESA observing.