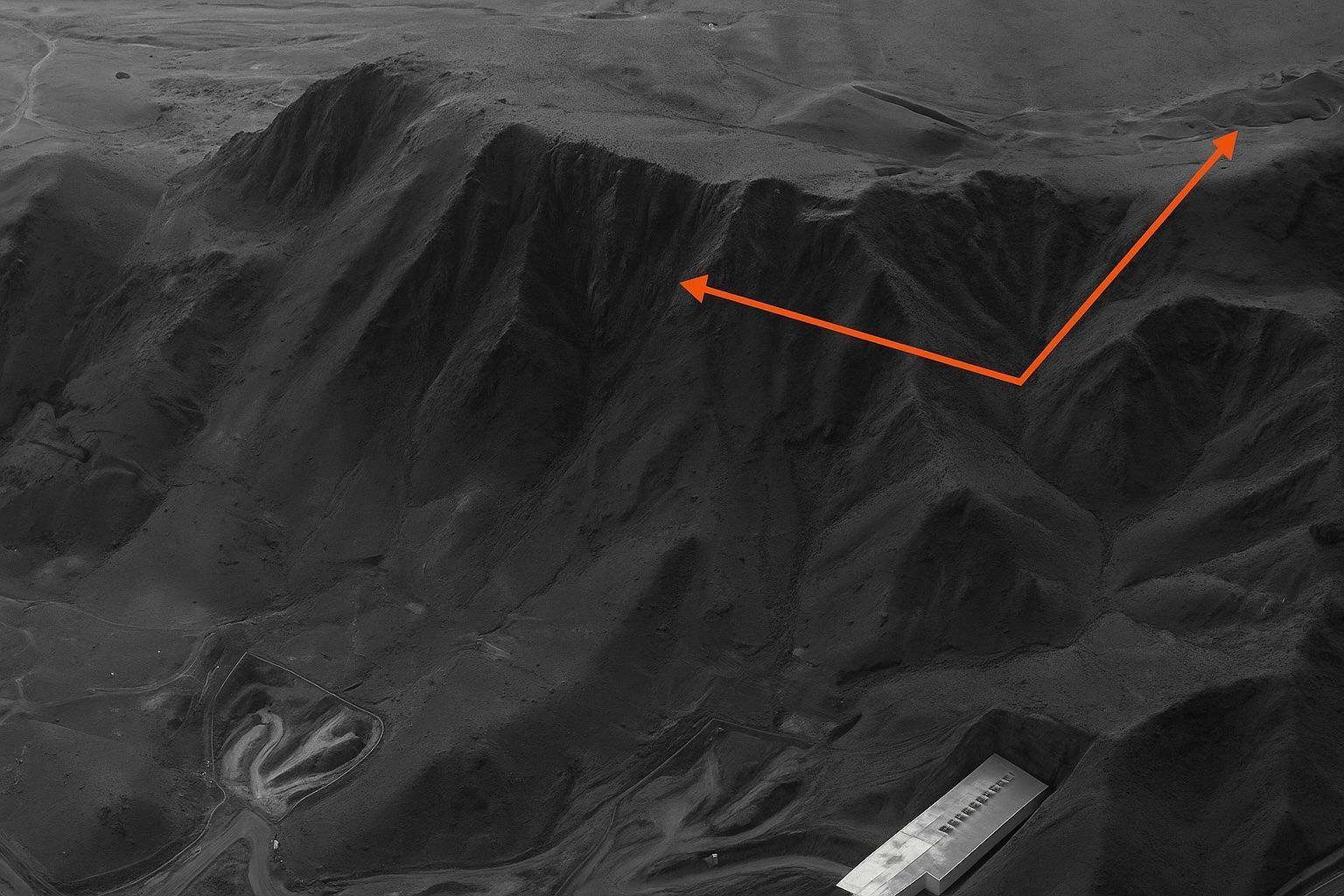

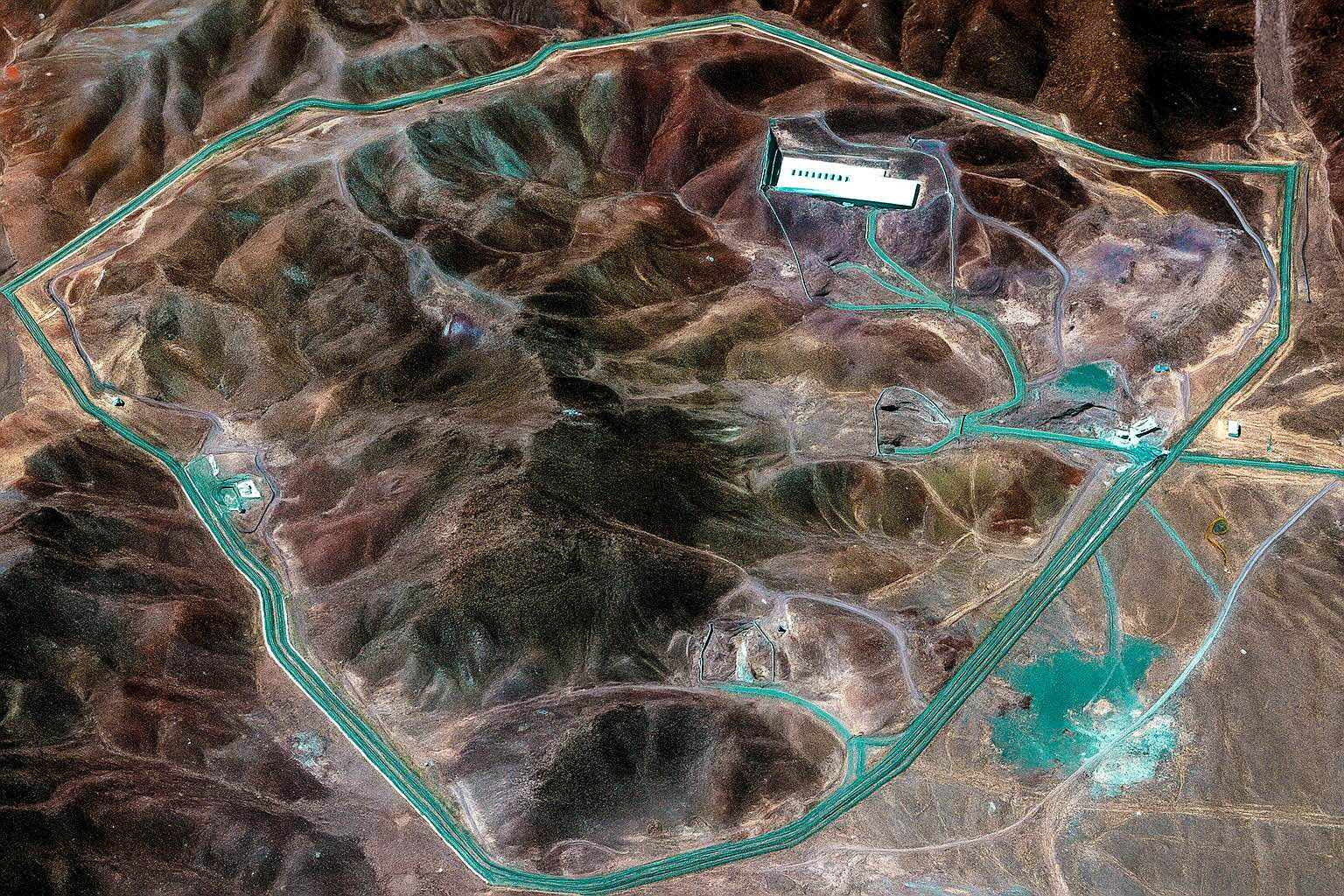

Stunning Satellite Images Reveal Fordow Nuclear Facility Cratered by U.S. Airstrike

Satellite images show large craters and ash fields above Iran’s Fordow uranium facility after U.S. B-2 bombers dropped 14 bunker-buster bombs in the “Midnight Hammer” strike. Pre-strike photos captured trucks and bulldozers moving heavy equipment at Fordow on June 19–20. The IAEA reported no radiation release; Iran confirmed enriched uranium had been removed. Damage to underground sections remains unverified.