Stellantis’ $13B U.S. Gamble Sparks Canada’s Fury – Legal Threats Over Jeep Plant Shift

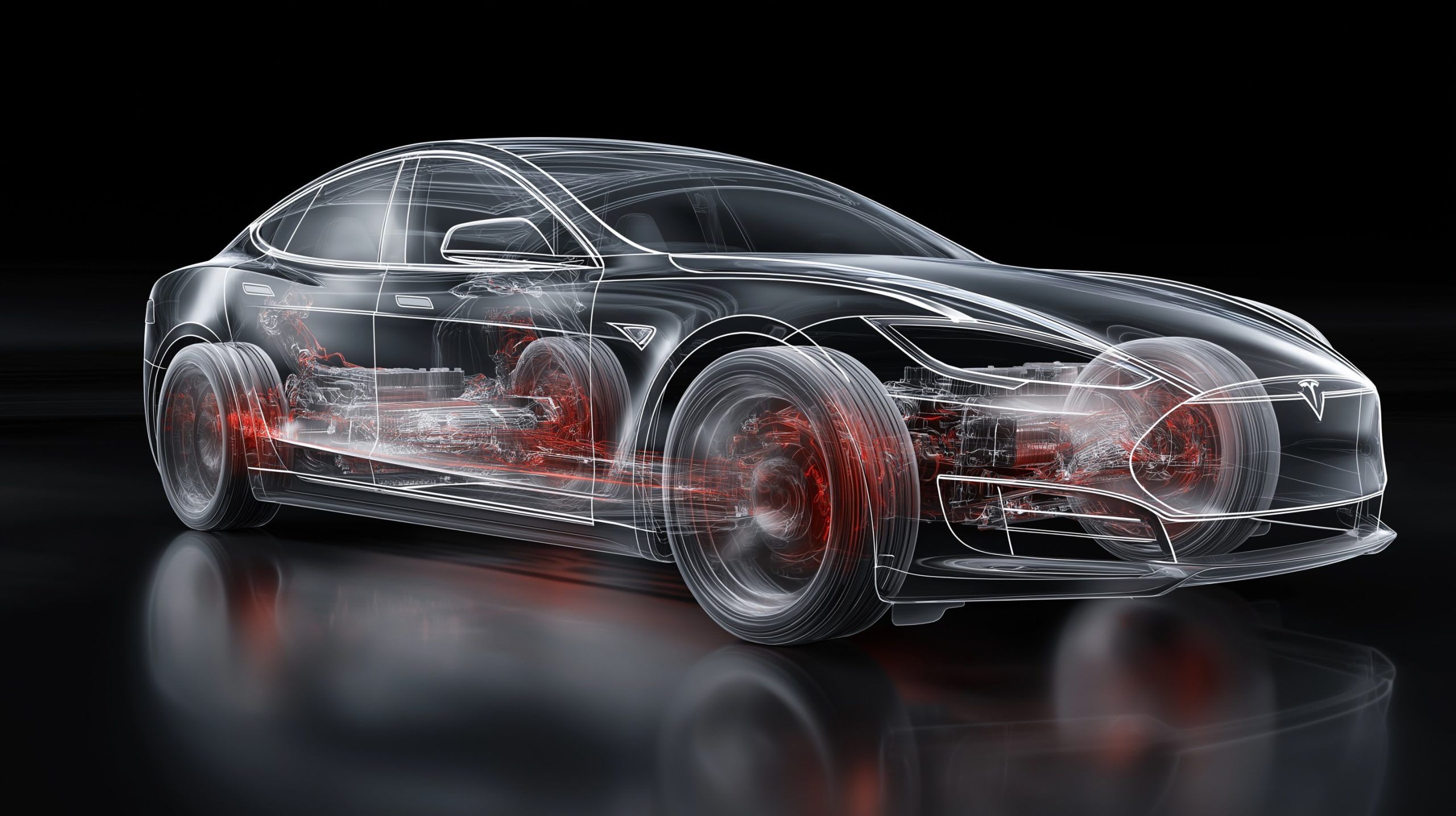

Stellantis will invest $13 billion to expand U.S. manufacturing, reopening its Belvidere, Illinois plant and adding 5,000 jobs. Production of the Jeep Compass will move from Canada to Illinois, prompting threats of legal action from Canadian officials who say the company broke subsidy agreements. The shift puts thousands of Canadian auto jobs at risk. U.S. unions praised the move as a win for tariffs.