Hungary’s Digital Lifeline: How Fiber, 5G, and Satellites Are Rewiring the Nation

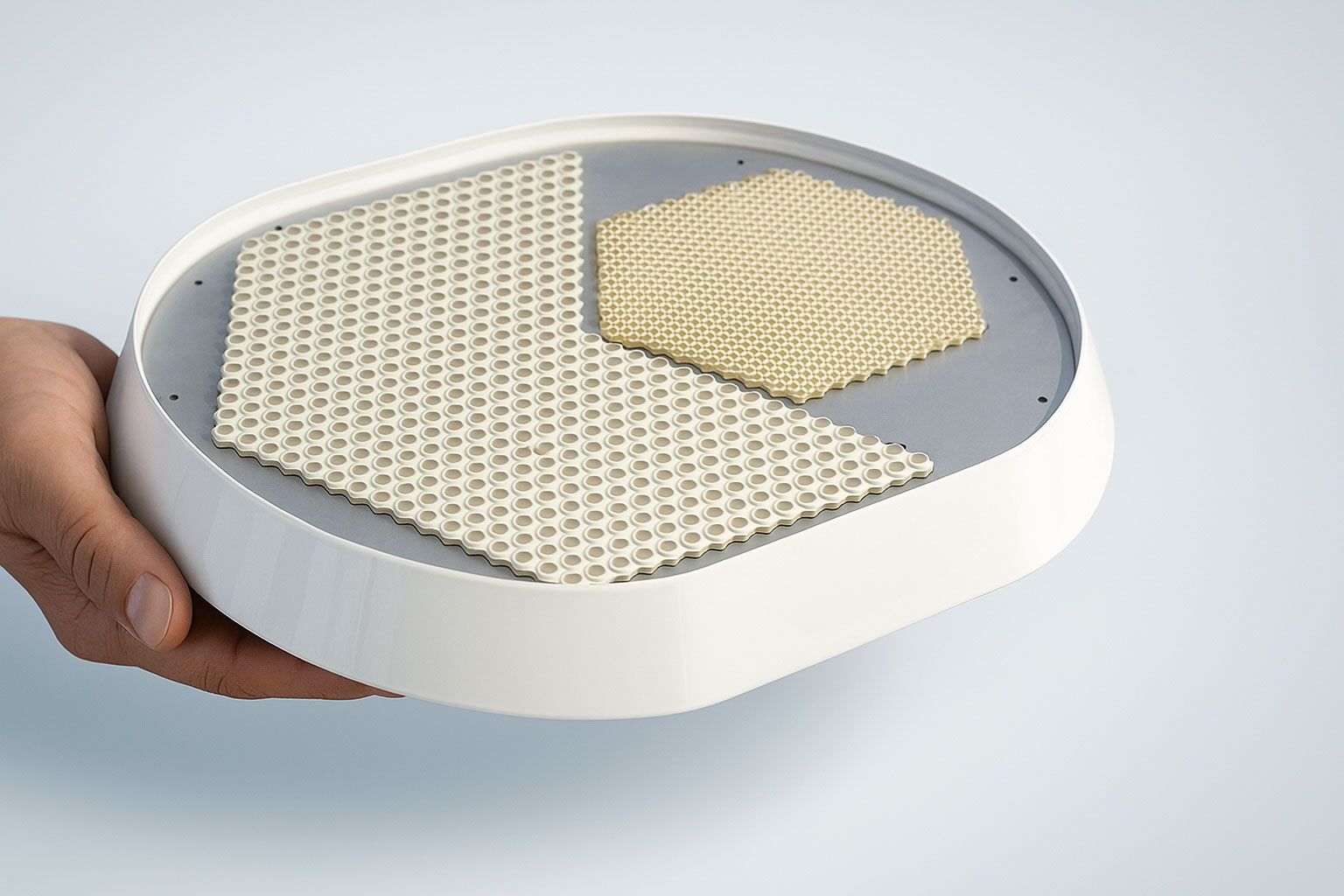

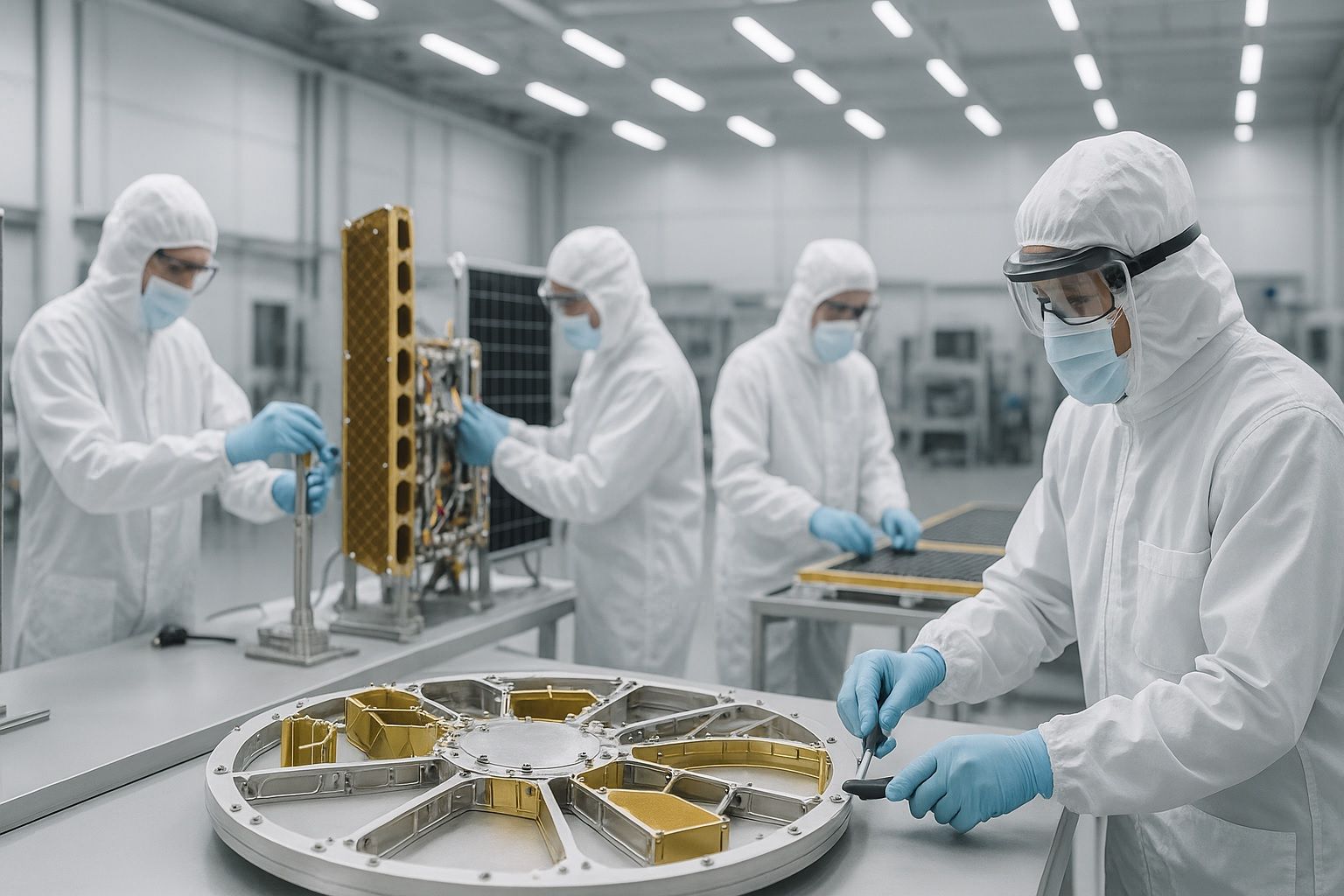

By late 2023, over 97% of Hungarian households had access to wired broadband, with pure fiber reaching 70%. Gigabit-speed networks passed two-thirds of homes by 2022, and 5G coverage expanded to 58% by end-2022. Magyar Telekom, Vodafone, and DIGI controlled most of the fixed broadband market, with Vodafone and DIGI merging by 2025. Starlink launched in 2022, offering satellite internet via a local reseller by 2024.