Lithium Americas 2025: Surging Stock, Big Bets and How It Stacks Up Against Lithium Giants

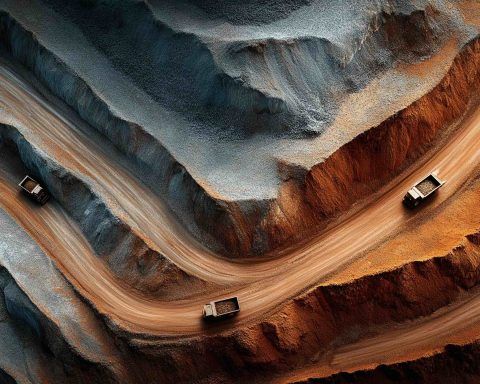

Lithium Americas (NYSE: LAC) shares more than doubled in 2025, surging from around $3 to $9 after securing a $2.26 billion U.S. Department of Energy loan and a 5% federal equity stake for its Thacker Pass project. General Motors also invested $330 million for a 9.4% stake. LAC remains pre-revenue, posting a $13 million Q2 loss, and analysts’ average price target sits well below current levels.